Page 28 - Insurance Times December 2022

P. 28

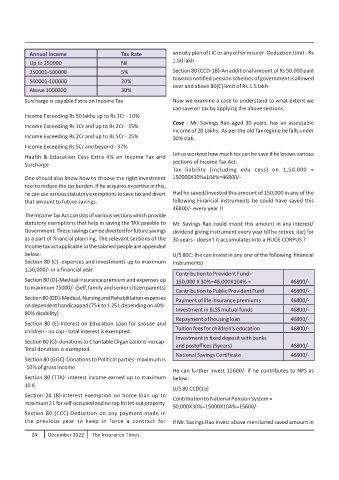

Annual income Tax Rate annuity plan of LIC or any other insurer- Deduction Limit - Rs

1.50 lakh

Up to 250000 Nil

250001-500000 5% Section 80 (CCD-1B)-An additional amount of Rs 50,000 paid

towards notified pension schemes of government is allowed

500001-100000 20%

over and above 80(C) limit of Rs.1.5 lakh

Above 1000000 30%

Surcharge is payable Extra on Income Tax Now we examine a case to understand to what extent we

can save on tax by applying the above sections.

Income Exceeding Rs 50 lakhs up to Rs 1Cr - 10%

Case : Mr. Savings Rao-aged 30 years, has an assessable

Income Exceeding Rs 1Cr and up to Rs 2Cr - 15%

income of 20 Lakhs. As per the old Tax regime he falls under

Income Exceeding Rs 2Cr and up to Rs 5Cr - 25%

30% slab.

Income Exceeding Rs 5Cr and beyond - 37%

Let us workout how much tax can he save if he knows various

Health & Education Cess Extra 4% on Income Tax and

sections of Income Tax Act:

Surcharge

Tax liability (including edu cess) on 1,50,000 =

One should also know how to choose the right investment 150000X30%x104%=46800/-

tool to reduce the tax burden. If he acquires expertise in this,

he can use various statutory exemptions to save tax and divert Had he saved/invested this amount of 150,000 in any of the

that amount to future savings. following Financial instruments he could have saved this

46800/- every year !!

The Income Tax Act consists of various sections which provide

statutory exemptions that help in saving the TAX payable to Mr. Savings Rao could invest this amount in any interest/

Government. These savings can be diverted for future savings dividend giving instrument every year till he retires i(ie) for

as a part of financial planning. The relevant sections of the 30 years - doesn't it accumulates into a HUGE CORPUS ?

Income tax act applicable to the salaried people are appended

below: U/S 80C: (he can invest in any one of the following financial

Section 80 (C) -expenses and investments up to maximum instruments)

1,50,000/- in a financial year.

Contribution to Provident Fund -

Section 80 (D)-Medical insurance premium and expenses up

150,000 X 30%=45,000X104% = 46800/-

to maximum 75000/- (Self, family and senior citizen parents)

Contribution to Public Provident Fund 46800/-

Section 80 (DD)-Medical, Nursing and Rehabilitation expenses

Payment of life insurance premiums 46800/-

on dependent handicapped (75 k to 1.25 L depending on 40%-

Investment in ELSS mutual funds 46800/-

80% disability)

Repayment of housing loan 46800/-

Section 80 (E)-Interest on Education Loan for spouse and

Tuition fees for children's education 46800/-

children - no cap - total interest is exempted.

Investment in fixed deposit with banks

Section 80 (G)- donations to Charitable Organizations -no cap-

and postoffices (5years) 46800/-

Total donation is exempted.

National Savings Certificate 46800/-

Section 80 (GGC)-Donations to Political parties- maximum is

-10% of gross Income

He can further invest 15600/- if he contributes to NPS as

Section 80 (TTA)- interest income earned up to maximum below:

10 K

U/S 80 CCD(1b)

Section 24 (B)-interest exemption on home loan up to

Contribution to National Pension System =

maximum 2 L for self-occupied and no cap for let-out property.

50,000X30%=15000X104%=15600/-

Section 80 (CCC)-Deduction on any payment made in

the previous year to keep in force a contract for If Mr. Savings Rao invest above mentioned saved amount in

24 December 2022 The Insurance Times