Page 16 - DTPA Journal Aug 18

P. 16

DTPA - J | 2017-18 | Volume 3 | August 2018

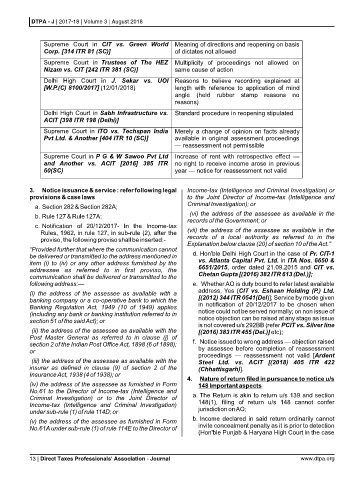

Supreme Court in CIT vs. Green World Meaning of directions and reopening on basis

Corp. [314 ITR 81 (SC)] of dictates not allowed

Supreme Court in Trustees of The HEZ Multiplicity of proceedings not allowed on

Nizam vs. CIT [242 ITR 381 (SC)] same cause of action

Delhi High Court in J. Sekar vs. UOI Reasons to believe recording explained at

[W.P.(C) 8100/2017] (12/01/2018) length with reference to application of mind

angle (held rubber stamp reasons no

reasons)

Delhi High Court in Sabh Infrastructure vs. Standard procedure in reopening stipulated

ACIT [398 ITR 198 (Delhi)]

Supreme Court in ITO vs. Techspan India Merely a change of opinion on facts already

Pvt Ltd. & Another [404 ITR 10 (SC)] available in original assessment proceedings

— reassessment not permissible

Supreme Court in P G & W Sawoo Pvt Ltd Increase of rent with retrospective effect —

and Another vs. ACIT [2016] 385 ITR no right to receive income arose in previous

60(SC) year — notice for reassessment not valid

3. Notice issuance & service : refer following legal Income-tax (Intelligence and Criminal Investigation) or

provisions & case laws to the Joint Director of Income-tax (Intelligence and

Criminal Investigation); or

a. Section 282 & Section 282A;

(vi) the address of the assessee as available in the

b. Rule 127 & Rule 127A;

records of the Government; or

c. Notification of 20/12/2017- In the Income-tax

Rules, 1962, in rule 127, in sub-rule (2), after the (vii) the address of the assessee as available in the

proviso, the following proviso shall be inserted:- records of a local authority as referred to in the

Explanation below clause (20) of section 10 of the Act.”

“Provided further that where the communication cannot

be delivered or transmitted to the address mentioned in d. Hon'ble Delhi High Court in the case of Pr. CIT-1

item (i) to (iv) or any other address furnished by the vs. Atlanta Capital Pvt. Ltd. in ITA Nos. 6650 &

addressee as referred to in first proviso, the 6651/2015, order dated 21.09.2015 and CIT vs.

communication shall be delivered or transmitted to the Chetan Gupta [(2016) 382 ITR 613 (Del.)];

following address:— e. Whether AO is duty bound to refer latest available

address, Yes (CIT vs. Eshaan Holding (P.) Ltd.

(i) the address of the assessee as available with a

banking company or a co-operative bank to which the [(2012) 344 ITR 0541(Del)]; Service by mode given

Banking Regulation Act, 1949 (10 of 1949) applies in notification of 20/12/2017 to be chosen when

(including any bank or banking institution referred to in notice could not be served normally; on non issue of

section 51 of the said Act); or notice objection can be raised at any stage as issue

is not covered u/s 292BB (refer PCIT vs. Silver line

(ii) the address of the assessee as available with the [(2016) 383 ITR 455 (Del.)] etc);

Post Master General as referred to in clause (j) of

section 2 of the Indian Post Office Act, 1898 (6 of 1898); f. Notice issued to wrong address — objection raised

or by assessee before completion of reassessment

proceedings — reassessment not valid [Ardent

(iii) the address of the assessee as available with the Steel Ltd. vs. ACIT [(2018) 405 ITR 422

insurer as defined in clause (9) of section 2 of the (Chhattisgarh)].

Insurance Act, 1938 (4 of 1938); or

4. Nature of return filed in pursuance to notice u/s

(iv) the address of the assessee as furnished in Form 148 Important aspects

No.61 to the Director of Income-tax (Intelligence and

Criminal Investigation) or to the Joint Director of a. The Return is akin to return u/s 139 and section

Income-tax (Intelligence and Criminal Investigation) 148(1), filing of return u/s 148 cannot confer

under sub-rule (1) of rule 114D; or jurisdiction on AO;

b. Income declared in said return ordinarily cannot

(v) the address of the assessee as furnished in Form

No.61A under sub-rule (1) of rule 114E to the Director of invite concealment penalty as it is prior to detection

(Hon'ble Punjab & Haryana High Court in the case

13 | Direct Taxes Professionals' Association - Journal www.dtpa.org