Page 17 - DTPA Journal Aug 18

P. 17

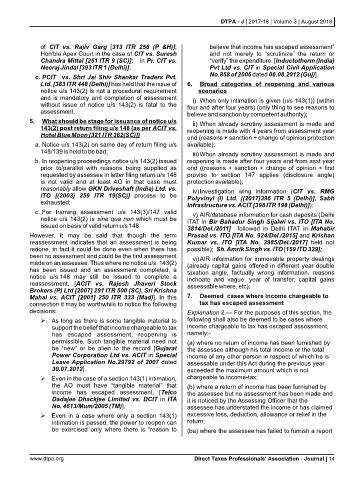

DTPA - J | 2017-18 | Volume 3 | August 2018

of CIT vs. Rajiv Garg [313 ITR 256 (P &H)]; believe that income has escaped assessment”

Hon'ble Apex Court in the case of CIT vs. Suresh and not merely to “scrutinize” the return or

Chandra Mittal [251 ITR 9 (SC)]; in Pr. CIT vs. “verify” the expenditure. [Inductotherm (India)

Neeraj Jindal [393 ITR 1 (Delhi)]; Pvt Ltd vs. CIT in Special Civil Application

No.858 of 2006 dated 06.08.2012 (Guj)].

c. PCIT vs. Shri Jai Shiv Shankar Traders Pvt.

Ltd. [383 ITR 448 (Delhi)] has held that the issue of 6. Broad categories of reopening and various

notice u/s 143(2) is not a procedural requirement scenarios

and is mandatory and completion of assessment i) When only intimation is given (u/s 143(1)) (within

without issue of notice u/s 143(2) is fatal to the four and after four years) (only thing to see reasons to

assessment.

believe and sanction by competent authority);

5. What should be stage for issuance of notice u/s ii) When already scrutiny assessment is made and

143(2) post return filing u/s 148 (as per ACIT vs. reopening is made with 4 years from assessment year

Hotel Blue Moon [321 ITR 362(SC)])

end (reasons + sanction + change of opinion protection

a. Notice u/s 143(2) on same day of return filing u/s available);

148/139 is held to be bad;

iii)When already scrutiny assessment is made and

b. In reopening proceedings notice u/s 143(2) issued reopening is made after four years end from asst year

prior to/parallel with reasons being supplied as end ((reasons + sanction + change of opinion + first

requested by assessee in letter filing return u/s 148 proviso to section 147 applies (disclosure angle)

is not valid and at least AO in that case must protection available);

reasonably allow GKN Driveshaft (India) Ltd. vs. iv)Investigation wing information (CIT vs. RMG

ITO [(2003) 259 ITR 19(SC)] process to be Polyvinyl (I) Ltd. [(2017)396 ITR 5 (Delhi)], Sabh

exhausted;

Infrastructure vs. ACIT [398 ITR 198 (Delhi)]);

c. For framing assessment u/s 143(3)/147 valid v) AIR/database information for cash deposits (Delhi

notice u/s 143(2) is sine qua non which must be ITAT in Bir Bahadur Singh Sijalwi vs. ITO [ITA No.

issued on basis of valid return u/s 148.

3814/Del./2011] followed in Delhi ITAT in Mahabir

However, it may be said that though the term Prasad vs. ITO [ITA No. 924/Del./2015] and Krishan

reassessment indicates that an assessment is being Kumar vs. ITO [ITA No. 3985/Del./2017] held not

redone, in fact it could be done even when there has possible); Sh. Amrik Singh vs. ITO [159 ITD 329];

been no assessment and could be the first assessment vi)AIR information for immovable property dealings

made on an assessee. Thus where no notice u/s. 143(2) (already capital gains offered in different year double

has been issued and an assessment completed, a taxation angle, factually wrong information, reasons

notice u/s.148 may still be issued to complete a inchoate and vague, year of transfer, capital gains

reassessment. [ACIT vs. Rajesh Jhaveri Stock assessable where, etc);

Brokers (P) Ltd [2007] 291 ITR 500 (SC), Sri Krishna

Mahal vs. ACIT [2001] 250 ITR 333 (Mad)]. In this 7. Deemed cases where income chargeable to

connection it may be worthwhile to notice the following tax has escaped assessment

decisions: Explanation 2.— For the purposes of this section, the

ØAs long as there is some tangible material to following shall also be deemed to be cases where

support the belief that income chargeable to tax income chargeable to tax has escaped assessment,

has escaped assessment, reopening is namely:-

permissible. Such tangible material need not (a) where no return of income has been furnished by

be “new” or be alien to the record [Gujarat the assessee although his total income or the total

Power Corporation Ltd vs. ACIT in Special income of any other person in respect of which he is

Leave Application No.29792 of 2007 dated assessable under this Act during the previous year

30.07.2012]. exceeded the maximum amount which is not

ØEven in the case of a section 143(1) intimation, chargeable to income-tax;

the AO must have “tangible material” that (b) where a return of income has been furnished by

income has escaped assessment. [Telco the assessee but no assessment has been made and

Dadajee Dhackjee Limited vs. DCIT in ITA it is noticed by the Assessing Officer that the

No. 4613/Mum/2005 (TM)]. assessee has understated the income or has claimed

ØEven in a case where only a section 143(1) excessive loss, deduction, allowance or relief in the

intimation is passed, the power to reopen can return;

be exercised only where there is “reason to (ba) where the assessee has failed to furnish a report

www.dtpa.org Direct Taxes Professionals' Association - Journal | 14