Page 68 - Risk Management in current scenario

P. 68

difference market value of assets and liabilities within a certain timeframe

due to future changes in the asset prices or yield. In the context of market

risk, the changes that may take place in yield, stock market, property

prices, exchange rate etc.

From the context of this presentation and considering the Indian

environment in terms of investment norms, exposure to interest rate is

most important which impacts the most selling traditional products, both

participating and non-participating. The Indian insurers are not allowed

to invest overseas and also not allowed to invest in property; therefore,

exchange rate and movement in price of property are not important.

The focus here would be in exposure of interest rate risk to the Indian

insurer.

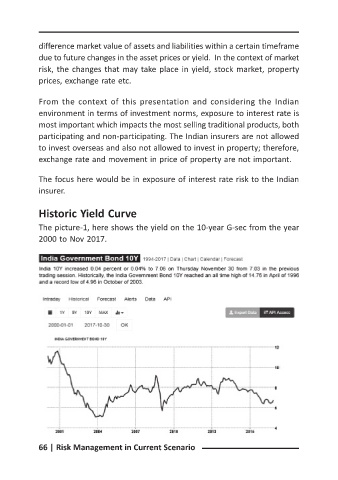

Historic Yield Curve

The picture-1, here shows the yield on the 10-year G-sec from the year

2000 to Nov 2017.

66 | Risk Management in Current Scenario