Page 42 - Insurance Times November 2020

P. 42

STANDARDISATION WILL MAKE

PRODUCT COMPARISON

EASIER

I n recent months, the Insurance Regulatory and increase in the premiums of health plans. But this is a good

Development Authority of India (IRDAI) has come up

move as it will provide greater confidence to customers at

the time of purchasing a plan,” says Naval Goel, chief

with several regulatory changes aimed at simplifying

health insurance and making it more customer-friendly.

Many of these changes came into force from the beginning executive officer (CEO), Policyx.com.

of this month. Let us try to understand how these changes The guidelines also require customers to make full disclosure.

will impact you, the policyholder. Says Amit Chhabra, head-health business, Policybazaar: “If

policyholders misrepresent facts or fail to disclose material

Standardisation of policy wordings: facts while buying a health insurance policy, they will forfeit

the premium paid. Insurers will also have the right to render

Starting from October 1, several important clauses in health

the policy void.”

insurance policies will be standardised. Insurers have been

asked to incorporate the same policy wordings, prescribed by

If an individual owns multiple policies, he will have the right

the regulator, across all products. According to S. Prakash,

managing director (MD), Star Health and Allied Insurance, to settle his claim from any of them. In such cases, the insurer

“Standardisation will be obliged to

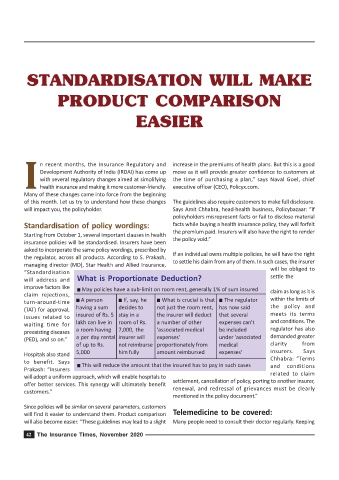

will address and What is Proportionate Deduction? settle the

improve factors like May policies have a sub-limit on room rent, generally 1% of sum insured

claim rejections, claim as long as it is

turn-around-time A person If, say, he What is crucial is that The regulator within the limits of

(TAT) for approval, having a sum decides to not just the room rent, has now said the policy and

insured of Rs. 5 stay in a the insurer will deduct that several meets its terms

issues related to

waiting time for lakh can live in room of Rs. a number of other expenses can't and conditions. The

preexisting diseases a room having 7,000, the 'associated medical be included regulator has also

(PED), and so on.” a per day rental insurer will expenses' under 'associated demanded greater

of up to Rs. not reimburse proportionately from medical clarity from

Hospitals also stand 5,000 him fully amount reimbursed expenses' insurers. Says

to benefit. Says This will reduce the amount that the insured has to pay in such cases Chhabra: “Terms

Prakash: “Insurers and conditions

will adopt a uniform approach, which will enable hospitals to related to claim

offer better services. This synergy will ultimately benefit settlement, cancellation of policy, porting to another insurer,

customers.” renewal, and redressal of grievances must be clearly

mentioned in the policy document.”

Since policies will be similar on several parameters, customers

will find it easier to understand them. Product comparison Telemedicine to be covered:

will also become easier. “These guidelines may lead to a slight Many people need to consult their doctor regularly. Keeping

42 The Insurance Times, November 2020