Page 33 - Insurance Times August 2020

P. 33

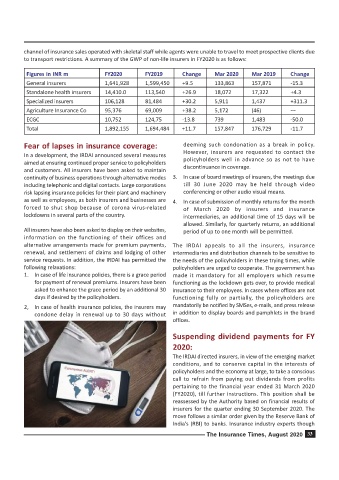

channel of insurance sales operated with skeletal staff while agents were unable to travel to meet prospective clients due

to transport restrictions. A summary of the GWP of non-life insurers in FY2020 is as follows:

Figures in INR m FY2020 FY2019 Change Mar 2020 Mar 2019 Change

General insurers 1,641,928 1,599,450 +9.5 133,863 157,871 -15.3

Standalone health insurers 14,410.0 113,540 +26.9 18,072 17,322 +4.3

Specialized insurers 106,128 81,484 +30.2 5,911 1,437 +311.3

Agriculture Insurance Co 95,376 69,009 +38.2 5,172 (46) ---

ECGC 10,752 124,75 -13.8 739 1,483 -50.0

Total 1,892,155 1,694,484 +11.7 157,847 176,729 -11.7

Fear of lapses in insurance coverage: deeming such condonation as a break in policy.

However, insurers are requested to contact the

In a development, the IRDAI announced several measures

aimed at ensuring continued proper service to policyholders policyholders well in advance so as not to have

and customers. All insurers have been asked to maintain discontinuance in coverage.

continuity of business operations through alternative modes 3. In case of board meetings of insurers, the meetings due

including telephonic and digital contacts. Large corporations till 30 June 2020 may be held through video

risk lapsing insurance policies for their plant and machinery conferencing or other audio visual means.

as well as employees, as both insurers and businesses are 4. In case of submission of monthly returns for the month

forced to shut shop because of corona virus-related of March 2020 by insurers and insurance

lockdowns in several parts of the country. intermediaries, an additional time of 15 days will be

allowed. Similarly, for quarterly returns, an additional

All insurers have also been asked to display on their websites, period of up to one month will be permitted.

information on the functioning of their offices and

alternative arrangements made for premium payments, The IRDAI appeals to all the insurers, insurance

renewal, and settlement of claims and lodging of other intermediaries and distribution channels to be sensitive to

service requests. In addition, the IRDAI has permitted the the needs of the policyholders in these trying times, while

following relaxations: policyholders are urged to cooperate. The government has

1. In case of life insurance policies, there is a grace period made it mandatory for all employers which resume

for payment of renewal premiums. Insurers have been functioning as the lockdown gets over, to provide medical

asked to enhance the grace period by an additional 30 insurance to their employees. In cases where offices are not

days if desired by the policyholders. functioning fully or partially, the policyholders are

2, In case of health insurance policies, the insurers may mandatorily be notified by SMSes, e-mails, and press release

condone delay in renewal up to 30 days without in addition to display boards and pamphlets in the brand

offices.

Suspending dividend payments for FY

2020:

The IRDAI directed insurers, in view of the emerging market

conditions, and to conserve capital in the interests of

policyholders and the economy at large, to take a conscious

call to refrain from paying out dividends from profits

pertaining to the financial year ended 31 March 2020

(FY2020), till further instructions. This position shall be

reassessed by the Authority based on financial results of

insurers for the quarter ending 30 September 2020. The

move follows a similar order given by the Reserve Bank of

India's (RBI) to banks. Insurance industry experts though

The Insurance Times, August 2020 33