Page 52 - Insurance Times May 2023

P. 52

policyholders for the additional expenses separately, there and long-term traditional endowment policies, despite the

will not be a direct impact on the cost to policyholders. fact that higher mortality charges associated with older age

However, insurance companies may indirectly pass on the groups can significantly reduce potential returns and

cost of agent/broker commissions to policyholders through ultimately impact the final pay-out. This highlights the need

increased premiums in the future. This means that for effective regulation and oversight by the IRDAI to ensure

customers may end up paying more for their insurance that insurance agents act ethically and in the best interests

policies due to higher expenses incurred by the insurance of their customers.

company.

Furthermore, the purpose of imposing limitations on

The regulator and insurers believe that increasing the commission and management expenses in the insurance

commission paid to insurance agents and brokers can help industry is to ensure that insurance companies prioritise

in increasing insurance penetration in the country as the their primary responsibility of managing policyholders' funds

agents will be motivated to sell more policies in order to effectively and efficiently without incurring high expenses.

earn a higher commission. The IRDAI is the regulatory body responsible for overseeing

the insurance industry in India and ensuring that companies

However, there is a potential downside to this approach. If comply with these regulations.

agents and brokers are too focused on earning a higher

commission, they may resort to unethical practices such as However, these new regulations suggest that the IRDAI is

mis-selling policies to customers. Mis-selling can involve playing a more developmental role rather than that of a

persuading customers to purchase policies that are not regulator by actively working on increasing insurance

suitable for their needs or providing misleading information penetration across the country. This could be a concern if

about the terms and conditions of a policy. The life insurance the regulator prioritises the interests of the insurance

sector has a lengthy record of grievances relating to agents industry over those of consumers or the general public,

and bank relationship managers promoting unsuitable which could lead to a situation where the insurance industry

insurance products to individuals. For instance, senior is developing but without actually benefiting the people it

citizens are often sold Unit Linked Insurance Policies (ULIPs) is meant to serve. (Source: PersonalFN)

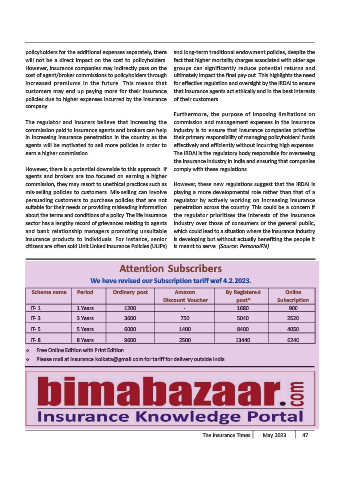

Attention Subscribers

We have revised our Subscription tariff wef 4.2.2023.

Scheme name Period Ordinary post Amazon By Registered Online

Discount Voucher post* Subscription

IT- 1 1 Years 1200 - 1680 900

IT- 3 3 Years 3600 750 5040 2520

IT- 5 5 Years 6000 1400 8400 4050

IT- 8 8 Years 9600 2500 13440 6240

Free Online Edition with Print Edition

Please mail at insurance.kolkata@gmail.com for tariff for delivery outside India

The Insurance Times May 2023 47