Page 9 - Life Insurance Today January 2018

P. 9

such frauds. Insurers have blacklisted around 70 locations private insurers. According to the data from IRDAI,

to prevent fraudulent claims. solvency ratio of National Insurance is 1.26% and 1.59%

for Oriental Insurance as on March 2016. But New India

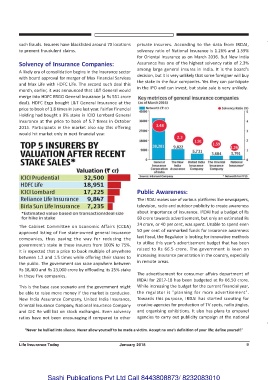

Solvency of Insurance Companies: Assurance has one of the highest solvency ratio of 2.3%

among large general insures in India. It is the board's

A likely era of consolidation begins in the insurance sector

decision, but it is very unlikely that some foreigner will buy

with board approval for merger of Max Financial Services

the stake in the four companies. Yes they can participate

and Max Life with HDFC Life. The second such deal this

in the IPO and can invest, but stake sale is very unlikely.

month, earlier, it was announced that L&T General would

merge into HDFC ERGO General Insurance (a Rs 551 crore

deal). HDFC Ergo bought L&T General Insurance at the

price to book of 1.8 times in June last year. Fairfax Financial

Holding had bought a 9% stake in ICICI Lombard General

Insurance at the price to book of 5.7 times in October

2015. Participants in the market also say this offering

would hit market only in next financial year.

Public Awareness:

The IRDAI makes use of various platforms like newspapers,

television, radio and outdoor publicity to create awareness

about importance of insurance. IRDAI had a budget of Rs

60 crore towards advertisement, but only an estimated Rs

24 crore, or 40 per cent, was spent. Unable to spend even

The Cabinet Committee on Economic Affairs (CCEA)

50 per cent of earmarked funds for insurance awareness

approved listing of five state-owned general insurance

companies, thus paving the way for reducing the last fiscal, the Regulator is looking for innovative methods

to utilise this year's advertisement budget that has been

government's stake in these insurers from 100% to 75%.

raised to Rs 66.5 crore. The government is keen on

It is expected that a price to book multiple of anywhere

increasing insurance penetration in the country, especially

between 1.2 and 1.5 times while offering their shares to

in remote areas.

the public. The government can raise anywhere between

Rs 18,400 and Rs 23,000 crore by offloading its 25% stake

The advertisement for consumer affairs department of

in these five companies.

IRDAI for 2017-18 has been budgeted at Rs 66.50 crore.

This is the base case scenario and the government might While increasing the budget for the current financial year,

be able to raise more money if the market is conducive. the regulator is "planning for more advertisement".

New India Assurance Company, United India Insurance, Towards this purpose, IRDAI has started scouting for

Oriental Insurance Company, National Insurance Company creative agencies for production of TV spots, radio jingles,

and GIC Re will list on stock exchanges. Even solvency and organising exhibitions. It also has plans to empanel

ratios have not been encouraging if compared to other agencies to carry out publicity campaign at the national

“Never be bullied into silence. Never allow yourself to be made a victim. Accept no one’s definition of your life; define yourself.”

Life Insurance Today January 2018 9

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010