Page 40 - Insurance Times October 2019

P. 40

number of industries has arguably set a trend in the storage It's important to note here that although the big organizations

and protection of data. With the rapid and constant largely remain targets, they accounted for less than 20% of the

progression of digitization and the development of newer cyber losses in the year 2016. Alternatively, smaller firms

technologies, industries have also become vulnerable to including those with less than $1 million in annual revenue

cyber threats. accounted for larger percentages of the losses.

To conclude, it is apt to essert that increasing connectivity

These are the prime reasons why a number of trends are

through various digital devices, government's emphasizing

emerging in the cyber insurance sector such as the

on digitization, sky-scraping cybercrime rate, European

increasing demand for cyber insurance policy in various

Union's General Data Protection Regulation, increasing use

sectors beyond retail, healthcare, and financial institutions

of social media, increased awareness of making digital

like professional services. Some shifts in the factors driving

payments but poor awareness about cyber-security are the

sales can also be noticed, specifically as more third parties

main reasons behind the driving cyber insurance purchase

are requiring cyber insurance coverage.

in India.

With the emerging new causes of loss like cyber funds

transfer fraud and cyber extortion, the significance of first However, one must keep in mind that cyber insurance can't

party coverage is also changing. A growing interest can be protect an organization or business from cybercrime, but

similarly noticed regarding the coverage for bodily injury it can certainly help keep your business on a stable financial

or property damage due to any cyber event. state in case any significant cyber security event occurs. T

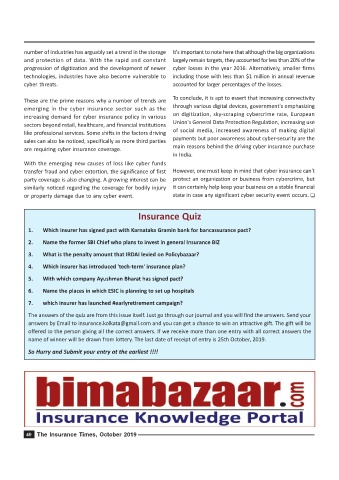

Insurance Quiz

1. Which insurer has signed pact with Karnataka Gramin bank for bancassurance pact?

2. Name the former SBI Chief who plans to invest in general Insurance BIZ

3. What is the penalty amount that IRDAI levied on Policybazaar?

4. Which insurer has introduced 'tech-term' insurance plan?

5. With which company Ayushman Bharat has signed pact?

6. Name the places in which ESIC is planning to set up hospitals

7. which insurer has launched #earlyretirement campaign?

The answers of the quiz are from this issue itself. Just go through our journal and you will find the answers. Send your

answers by Email to insurance.kolkata@gmail.com and you can get a chance to win an attractive gift. The gift will be

offered to the person giving all the correct answers. If we receive more than one entry with all correct answers the

name of winner will be drawn from lottery. The last date of receipt of entry is 25th October, 2019.

So Hurry and Submit your entry at the earliest !!!!

40 The Insurance Times, October 2019