Page 52 - Banking Finance March 2019

P. 52

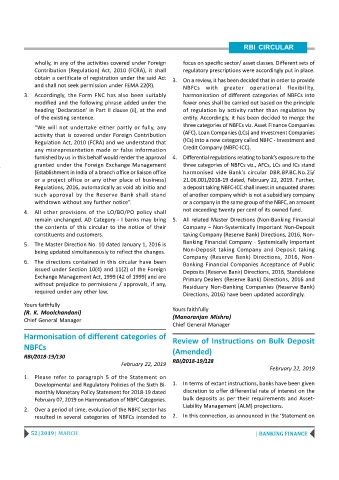

RBI CIRCULAR

wholly, in any of the activities covered under Foreign focus on specific sector/ asset classes. Different sets of

Contribution (Regulation) Act, 2010 (FCRA), it shall regulatory prescriptions were accordingly put in place.

obtain a certificate of registration under the said Act 3. On a review, it has been decided that in order to provide

and shall not seek permission under FEMA 22(R). NBFCs with greater operational flexibility,

3. Accordingly, the Form FNC has also been suitably harmonisation of different categories of NBFCs into

modified and the following phrase added under the fewer ones shall be carried out based on the principle

heading ‘Declaration’ in Part II clause (ii), at the end of regulation by activity rather than regulation by

of the existing sentence. entity. Accordingly, it has been decided to merge the

“We will not undertake either partly or fully, any three categories of NBFCs viz. Asset Finance Companies

activity that is covered under Foreign Contribution (AFC), Loan Companies (LCs) and Investment Companies

Regulation Act, 2010 (FCRA) and we understand that (ICs) into a new category called NBFC - Investment and

any misrepresentation made or false information Credit Company (NBFC-ICC).

furnished by us in this behalf would render the approval 4. Differential regulations relating to bank’s exposure to the

granted under the Foreign Exchange Management three categories of NBFCs viz., AFCs, LCs and ICs stand

(Establishment in India of a branch office or liaison office harmonised vide Bank’s circular DBR.BP.BC.No.25/

or a project office or any other place of business) 21.06.001/2018-19 dated, February 22, 2019. Further,

Regulations, 2016, automatically as void ab initio and a deposit taking NBFC-ICC shall invest in unquoted shares

such approval by the Reserve Bank shall stand of another company which is not a subsidiary company

withdrawn without any further notice”. or a company in the same group of the NBFC, an amount

4. All other provisions of the LO/BO/PO policy shall not exceeding twenty per cent of its owned fund.

remain unchanged. AD Category - I banks may bring 5. All related Master Directions (Non-Banking Financial

the contents of this circular to the notice of their Company – Non-Systemically Important Non-Deposit

constituents and customers. taking Company (Reserve Bank) Directions, 2016, Non-

5. The Master Direction No. 10 dated January 1, 2016 is Banking Financial Company - Systemically Important

being updated simultaneously to reflect the changes. Non-Deposit taking Company and Deposit taking

Company (Reserve Bank) Directions, 2016, Non-

6. The directions contained in this circular have been

Banking Financial Companies Acceptance of Public

issued under Section 10(4) and 11(2) of the Foreign

Deposits (Reserve Bank) Directions, 2016, Standalone

Exchange Management Act, 1999 (42 of 1999) and are Primary Dealers (Reserve Bank) Directions, 2016 and

without prejudice to permissions / approvals, if any, Residuary Non-Banking Companies (Reserve Bank)

required under any other law.

Directions, 2016) have been updated accordingly.

Yours faithfully

(R. K. Moolchandani) Yours faithfully

(Manoranjan Mishra)

Chief General Manager

Chief General Manager

Harmonisation of different categories of

Review of Instructions on Bulk Deposit

NBFCs

(Amended)

RBI/2018-19/130

February 22, 2019 RBI/2018-19/128

February 22, 2019

1. Please refer to paragraph 5 of the Statement on

Developmental and Regulatory Policies of the Sixth Bi- 1. In terms of extant instructions, banks have been given

monthly Monetary Policy Statement for 2018-19 dated discretion to offer differential rate of interest on the

February 07, 2019 on Harmonisation of NBFC Categories. bulk deposits as per their requirements and Asset-

Liability Management (ALM) projections.

2. Over a period of time, evolution of the NBFC sector has

resulted in several categories of NBFCs intended to 2. In this connection, as announced in the ‘Statement on

52 | 2019 | MARCH | BANKING FINANCE