Page 53 - Banking Finance March 2019

P. 53

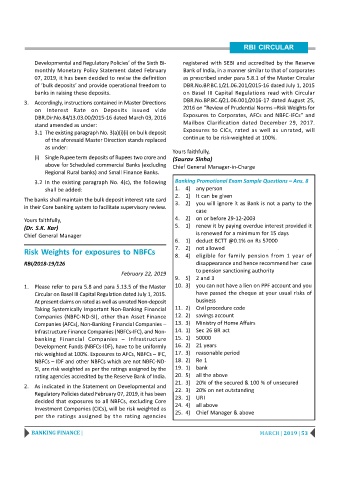

RBI CIRCULAR

Developmental and Regulatory Policies’ of the Sixth Bi- registered with SEBI and accredited by the Reserve

monthly Monetary Policy Statement dated February Bank of India, in a manner similar to that of corporates

07, 2019, it has been decided to revise the definition as prescribed under para 5.8.1 of the Master Circular

of ‘bulk deposits’ and provide operational freedom to DBR.No.BP.BC.1/21.06.201/2015-16 dated July 1, 2015

banks in raising these deposits. on Basel III Capital Regulations read with Circular

3. Accordingly, instructions contained in Master Directions DBR.No.BP.BC.6/21.06.001/2016-17 dated August 25,

2016 on “Review of Prudential Norms –Risk Weights for

on Interest Rate on Deposits issued vide

Exposures to Corporates, AFCs and NBFC-IFCs” and

DBR.Dir.No.84/13.03.00/2015-16 dated March 03, 2016

Mailbox Clarification dated December 29, 2017.

stand amended as under:

Exposures to CICs, rated as well as unrated, will

3.1 The existing paragraph No. 3(a)(i)(i) on bulk deposit

of the aforesaid Master Direction stands replaced continue to be risk-weighted at 100%.

as under:

Yours faithfully,

(i) Single Rupee term deposits of Rupees two crore and (Saurav Sinha)

above for Scheduled commercial Banks (excluding Chief General Manager-in-Charge

Regional Rural banks) and Small Finance Banks.

3.2 In the existing paragraph No. 4(c), the following Banking Promotional Exam Sample Questions – Ans. 8

shall be added: 1. 4] any person

2. 1] It can be given

The banks shall maintain the bulk deposit interest rate card

3. 2] you will ignore it as Bank is not a party to the

in their Core banking system to facilitate supervisory review.

case

Yours faithfully, 4. 2] on or before 29-12-2003

(Dr. S.K. Kar) 5. 1] renew it by paying overdue interest provided it

is renewed for a minimum for 15 days

Chief General Manager

6. 1] deduct BCTT @0.1% on Rs 57000

7. 2] not allowed

Risk Weights for exposures to NBFCs

8. 4] eligible for family pension from 1 year of

RBI/2018-19/126 disappearance and hence recommend her case

to pension sanctioning authority

February 22, 2019

9. 5] 2 and 3

1. Please refer to para 5.8 and para 5.13.5 of the Master 10. 3] you can not have a lien on PPF account and you

Circular on Basel III Capital Regulation dated July 1, 2015. have passed the cheque at your usual risks of

At present claims on rated as well as unrated Non-deposit business

Taking Systemically Important Non-Banking Financial 11. 2) Civil procedure code

Companies (NBFC-ND-SI), other than Asset Finance 12. 2) savings account

Companies (AFCs), Non-Banking Financial Companies – 13. 3) Ministry of Home Affairs

Infrastructure Finance Companies (NBFCs-IFC), and Non- 14. 1) Sec 26 BR act

banking Financial Companies – Infrastructure 15. 1) 50000

Development Funds (NBFCs-IDF), have to be uniformly 16. 2) 21 years

risk weighted at 100%. Exposures to AFCs, NBFCs – IFC, 17. 3) reasonable period

NBFCs – IDF and other NBFCs which are not NBFC-ND- 18. 2) Re 1

SI, are risk weighted as per the ratings assigned by the 19. 1) bank

rating agencies accredited by the Reserve Bank of India. 20. 5) all the above

21. 3] 20% of the secured & 100 % of unsecured

2. As indicated in the Statement on Developmental and

22. 3) 20% on net outstanding

Regulatory Policies dated February 07, 2019, it has been

23. 1] URI

decided that exposures to all NBFCs, excluding Core

Investment Companies (CICs), will be risk weighted as 24. 4) all above

per the ratings assigned by the rating agencies 25. 4) Chief Manager & above

BANKING FINANCE | MARCH | 2019 | 53