Page 4 - ACI World Wide Super and Insurance Booklet_July 2020

P. 4

04 | Making Possibilities Happen

Super Plan Features

Investing through super is a tax-effective way to save and prepare for

your retirement. In fact, for many Australians, super could grow to be the

largest asset owned. So it’s important to understand how it works, and

how you can be in control of your super savings.

MLC MySuper – Default Investment

MySuper is the investment option where your super will be invested if you do not make an investment

choice. You can find more information on the MLC MySuper investment option in the Welcome Kit available

online once your account has been set up or via the MLC MasterKey Business Super Product Disclosure

Statement.

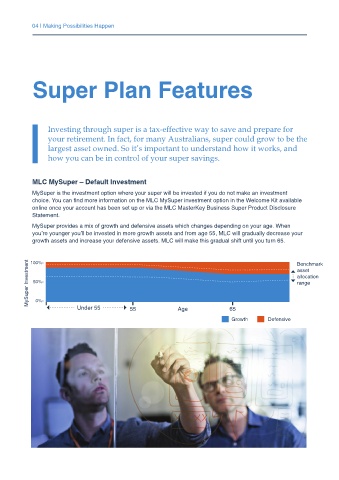

MySuper provides a mix of growth and defensive assets which changes depending on your age. When

you’re younger you’ll be invested in more growth assets and from age 55, MLC will gradually decrease your

growth assets and increase your defensive assets. MLC will make this gradual shift until you turn 65.

MySuper Investment 100%- Benchmark

asset

allocation

50%-

range

0%-

Under 55 55 Age 65

Growth Defensive