Page 5 - ACI World Wide Super and Insurance Booklet_July 2020

P. 5

Making Possibilities Happen | 05

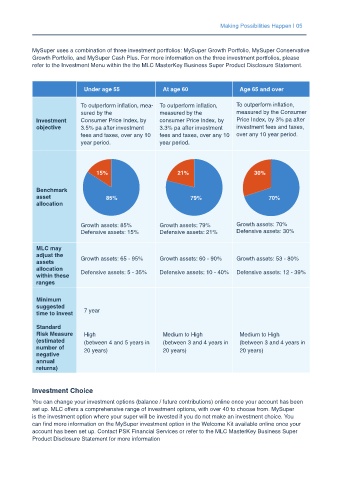

MySuper uses a combination of three investment portfolios: MySuper Growth Portfolio, MySuper Conservative

Growth Portfolio, and MySuper Cash Plus. For more information on the three investment portfolios, please

refer to the Investment Menu within the the MLC MasterKey Business Super Product Disclosure Statement.

Under age 55 At age 60 Age 65 and over

To outperform inflation, mea- To outperform inflation, To outperform inflation,

sured by the measured by the measured by the Consumer

Investment Consumer Price Index, by consumer Price Index, by Price Index, by 3% pa after

objective 3.5% pa after investment 3.3% pa after investment investment fees and taxes,

fees and taxes, over any 10 fees and taxes, over any 10 over any 10 year period.

year period. year period.

15% 21% 30%

Benchmark

asset 85% 79% 70%

allocation

Growth assets: 85% Growth assets: 79% Growth assets: 70%

Defensive assets: 15% Defensive assets: 21% Defensive assets: 30%

MLC may

adjust the

Growth assets: 65 - 95% Growth assets: 60 - 90% Growth assets: 53 - 80%

assets

Benchmark

asset allocation Defensive assets: 5 - 35% Defensive assets: 10 - 40% Defensive assets: 12 - 39%

allocation within these

range ranges

Minimum

suggested

7 year

time to invest

Standard

Risk Measure High Medium to High Medium to High

(estimated (between 4 and 5 years in (between 3 and 4 years in (between 3 and 4 years in

number of

20 years) 20 years) 20 years)

negative

annual

returns)

Investment Choice

You can change your investment options (balance / future contributions) online once your account has been

set up. MLC offers a comprehensive range of investment options, with over 40 to choose from. MySuper

is the investment option where your super will be invested if you do not make an investment choice. You

can find more information on the MySuper investment option in the Welcome Kit available online once your

account has been set up. Contact PSK Financial Services or refer to the MLC MasterKey Business Super

Product Disclosure Statement for more information