Page 9 - ACI World Wide Super and Insurance Booklet_July 2020

P. 9

Making Possibilities Happen | 09

Employer paid insurance cover

ACI Worldwide reimburses the cost of Death and Total and Permanent Disablement Insurance premiums for

default cover. Further information will be provided within your MLC Welcome Kit once your account is set up.

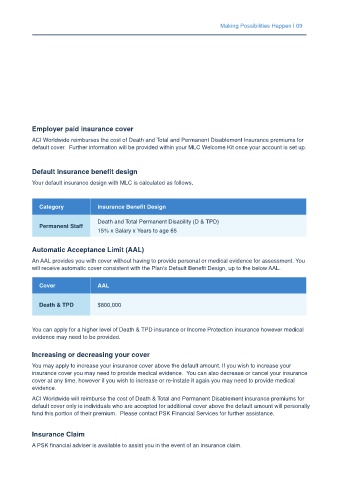

Default insurance benefit design

Your default insurance design with MLC is calculated as follows.

Category Insurance Benefit Design

Death and Total Permanent Disability (D & TPD)

Permanent Staff

15% x Salary x Years to age 65

Automatic Acceptance Limit (AAL)

An AAL provides you with cover without having to provide personal or medical evidence for assessment. You

will receive automatic cover consistent with the Plan’s Default Benefit Design, up to the below AAL.

Cover AAL

Death & TPD $800,000

You can apply for a higher level of Death & TPD insurance or Income Protection insurance however medical

evidence may need to be provided.

Increasing or decreasing your cover

You may apply to increase your insurance cover above the default amount. If you wish to increase your

insurance cover you may need to provide medical evidence. You can also decrease or cancel your insurance

cover at any time, however if you wish to increase or re-instate it again you may need to provide medical

evidence.

ACI Worldwide will reimburse the cost of Death & Total and Permanent Disablement insurance premiums for

default cover only ie individuals who are accepted for additional cover above the default amount will personally

fund this portion of their premium. Please contact PSK Financial Services for further assistance.

Insurance Claim

A PSK financial adviser is available to assist you in the event of an insurance claim.