Page 45 - for PDF DOWNLOAD Copy of 5.23.23 Final Copy of 2023 BUYERSHOME GUIDE

P. 45

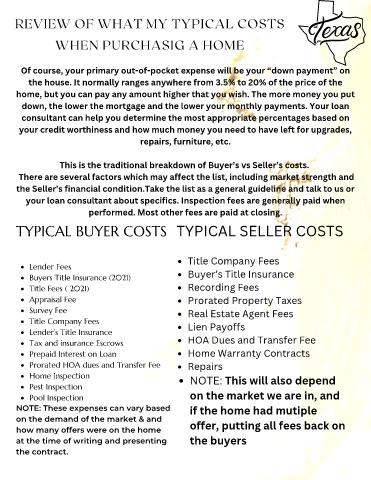

REVIEW OF WHAT MY TYPICAL COSTS

WHEN PURCHASIG A HOME

Of course, your primary out-of-pocket expense will be your “down payment” on

the house. It normally ranges anywhere from 3.5% to 20% of the price of the

home, but you can pay any amount higher that you wish. The more money you put

down, the lower the mortgage and the lower your monthly payments. Your loan

consultant can help you determine the most appropriate percentages based on

your credit worthiness and how much money you need to have left for upgrades,

repairs, furniture, etc.

This is the traditional breakdown of Buyer’s vs Seller’s costs.

There are several factors which may affect the list, including market strength and

the Seller’s financial condition.Take the list as a general guideline and talk to us or

your loan consultant about specifics. Inspection fees are generally paid when

performed. Most other fees are paid at closing.

TYPICAL BUYER COSTS TYPICAL SELLER COSTS

Title Company Fees

Lender Fees

Buyers Title Insurance (2021) Buyer’s Title Insurance

Title Fees ( 2021) Recording Fees

Appraisal Fee Prorated Property Taxes

Survey Fee Real Estate Agent Fees

Title Company Fees Lien Payoffs

Lender’s Title Insurance

Tax and insurance Escrows HOA Dues and Transfer Fee

Prepaid Interest on Loan Home Warranty Contracts

Prorated HOA dues and Transfer Fee Repairs

Home Inspection NOTE: This will also depend

Pest Inspection

Pool Inspection on the market we are in, and

NOTE: These expenses can vary based if the home had mutiple

on the demand of the market & and

how many offers were on the home offer, putting all fees back on

at the time of writing and presenting the buyers

the contract.