Page 59 - Report Final MMIX 31 Des 2022

P. 59

These financial statements are originally issued in Indonesian language.

- 48 -

PT MULTI MEDIKA INTERNASIONAL Tbk PT MULTI MEDIKA INTERNASIONAL Tbk

CATATAN ATAS LAPORAN KEUANGAN (Lanjutan) NOTES TO THE FINANCIAL STATEMENTS (Continued)

UNTUK 31 DESEMBER 2022 DAN 2021 DECEMBER 31, 2022 AND 2021

(Disajikan dalam Rupiah, kecuali dinyatakan lain) (Expressed in Rupiah, unless otherwise stated)

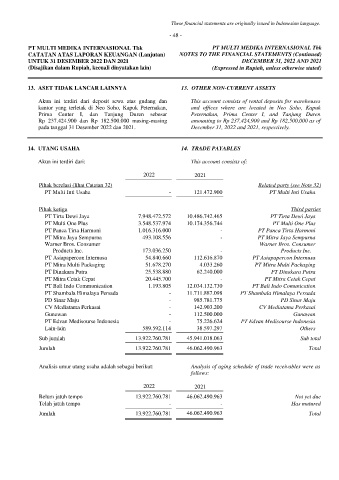

13. ASET TIDAK LANCAR LAINNYA 13. OTHER NON-CURRENT ASSETS

Akun ini terdiri dari deposit sewa atas gudang dan This account consists of rental deposits for warehouses

kantor yang terletak di Neo Soho, Kapuk Peternakan, and offices where are located in Neo Soho, Kapuk

Prima Center I, dan Tanjung Duren sebesar Peternakan, Prima Center I, and Tanjung Duren

Rp 237.424.900 dan Rp 182.500.000 masing-masing amounting to Rp 237,424,900 and Rp 182,500,000 as of

pada tanggal 31 Desember 2022 dan 2021. December 31, 2022 and 2021, respectively.

14. UTANG USAHA 14. TRADE PAYABLES

Akun ini terdiri dari: This account consists of:

2022 2021

Pihak berelasi (lihat Catatan 32) Related party (see Note 32)

PT Multi Inti Usaha - 121.472.900 PT Multi Inti Usaha

Pihak ketiga Third parties

PT Tirta Dewi Jaya 7.948.472.572 10.486.742.465 PT Tirta Dewi Jaya

PT Multi One Plus 3.548.537.974 10.174.356.744 PT Multi One Plus

PT Panca Tirta Harmoni 1.016.316.000 - PT Panca Tirta Harmoni

PT Mitra Jaya Sempurna 493.108.556 - PT Mitra Jaya Sempurna

Warner Bros. Consumer Warner Bros. Consumer

Products Inc. 173.036.250 - Products Inc.

PT Asiapapercon Internusa 54.840.660 112.616.870 PT Asiapapercon Internusa

PT Mitra Multi Packaging 51.678.270 4.033.260 PT Mitra Multi Packaging

PT Dinakara Putra 25.538.880 62.240.000 PT Dinakara Putra

PT Mitra Cetak Cepat 20.445.700 - PT Mitra Cetak Cepat

PT Bali Indo Communication 1.193.805 12.034.132.730 PT Bali Indo Comunication

PT Shambala Himalaya Persada - 11.711.887.098 PT Shambala Himalaya Persada

PD Sinar Maju - 985.781.775 PD Sinar Maju

CV Mediatama Perkasai - 142.903.200 CV Mediatama Perkasai

Gunawan - 112.500.000 Gunawan

PT Edvan Medisourse Indonesia - 75.226.624 PT Edvan Medisourse Indonesia

Lain-lain 589.592.114 38.597.297 Others

Sub jumlah 13.922.760.781 45.941.018.063 Sub total

Jumlah 13.922.760.781 46.062.490.963 Total

Analisis umur utang usaha adalah sebagai berikut: Analysis of aging schedule of trade receivables were as

follows:

2022 2021

Belum jatuh tempo 13.922.760.781 46.062.490.963 Not yet due

Telah jatuh tempo - - Has matured

Jumlah 13.922.760.781 46.062.490.963 Total