Page 31 - 2019-20 CAFR

P. 31

Rogue Community College

Fiscal Year Ended June 30, 2020

The entity-wide financial statements are designed to provide readers with a broad overview of the College’s

finances in a manner similar to a private-sector business. These entity-wide statements consist of

comparative statements including: Statement of Net Position, Statement of Revenues, Expenses and Changes

in Net Position and the Statement of Cash Flows. The Notes to the Basic Financial Statements provide

additional information essential to a full understanding of the data provided in the entity-wide financial

statements.

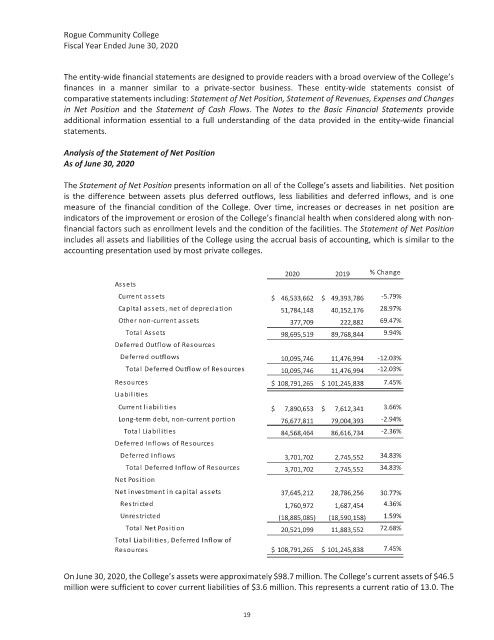

Analysis of the Statement of Net Position

As of June 30, 2020

The Statement of Net Position presents information on all of the College’s assets and liabilities. Net position

is the difference between assets plus deferred outflows, less liabilities and deferred inflows, and is one

measure of the financial condition of the College. Over time, increases or decreases in net position are

indicators of the improvement or erosion of the College’s financial health when considered along with non-

financial factors such as enrollment levels and the condition of the facilities. The Statement of Net Position

includes all assets and liabilities of the College using the accrual basis of accounting, which is similar to the

accounting presentation used by most private colleges.

2020 2019 % Cha nge

Assets

Current a s s e ts $ 46,533,662 $ 49,393,786 -5.79%

Capital as s ets , net of depreciation 51,784,148 40,152,176 28.97%

Other non-current a s sets 377,709 222,882 69.47%

Tota l As s ets 98,695,519 89,768,844 9.94%

Deferred Outfl ow of Resources

Deferred outfl ows 10,095,746 11,476,994 -12.03%

Total Deferred Outflow of Res ources 10,095,746 11,476,994 -12.03%

Res ources $ 108,791,265 $ 101,245,838 7.45%

Liabilities

Current liabilities $ 7,890,653 $ 7,612,341 3.66%

Long-term debt, non-current portion 76,677,811 79,004,393 -2.94%

Total Liabilities 84,568,464 86,616,734 -2.36%

Deferred Infl ows of Res ources

Deferred inflows 3,701,702 2,745,552 34.83%

Total Deferred Inflow of Res ources 3,701,702 2,745,552 34.83%

Net Pos i ti on

Net inves tment in capital as s ets 37,645,212 28,786,256 30.77%

Res tri cted 1,760,972 1,687,454 4.36%

Unre s tri cte d (18,885,085) (18,590,158) 1.59%

Total Net Pos ition 20,521,099 11,883,552 72.68%

Total Liabilities , Deferred Inflow of

Res ources $ 108,791,265 $ 101,245,838 7.45%

On June 30, 2020, the College’s assets were approximately $98.7 million. The College’s current assets of $46.5

million were sufficient to cover current liabilities of $3.6 million. This represents a current ratio of 13.0. The

19