Page 83 - 2019-20 CAFR

P. 83

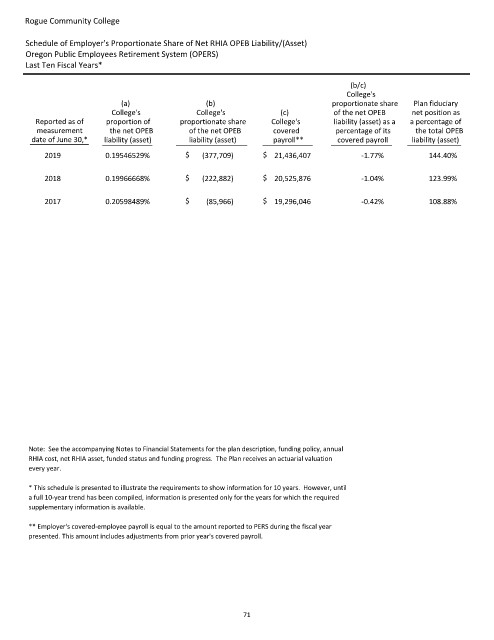

Rogue Community College

Schedule of Employer's Proportionate Share of Net RHIA OPEB Liability/(Asset)

Oregon Public Employees Retirement System (OPERS)

Last Ten Fiscal Years*

(b/c)

College's

(a) (b) proportionate share Plan fiduciary

College's College's (c) of the net OPEB net position as

Reported as of proportion of proportionate share College's liability (asset) as a a percentage of

measurement the net OPEB of the net OPEB covered percentage of its the total OPEB

date of June 30,* liability (asset) liability (asset) payroll** covered payroll liability (asset)

2019 0.19546529% $ (377,709) $ 21,436,407 1.77% 144.40%

2018 0.19966668% $ (222,882) $ 20,525,876 1.04% 123.99%

2017 0.20598489% $ (85,966) $ 19,296,046 0.42% 108.88%

Note: See the accompanying Notes to Financial Statements for the plan description, funding policy, annual

RHIA cost, net RHIA asset, funded status and funding progress. The Plan receives an actuarial valuation

every year.

* This schedule is presented to illustrate the requirements to show information for 10 years. However, until

a full 10year trend has been compiled, information is presented only for the years for which the required

supplementary information is available.

** Employer's coveredemployee payroll is equal to the amount reported to PERS during the fiscal year

presented. This amount includes adjustments from prior year's covered payroll.

71