Page 77 - New Agent Real Estate training book

P. 77

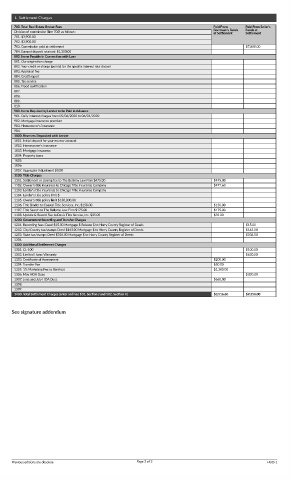

L. Se lement Charges

700. Total Real Estate Broker Fees Paid From Paid From Seller’s

Division of commission (line 700) as follows : Borrower's Funds Funds at

Se lement

at Se lement

701. $3,900.00

702. $3,900.00

703. Commission paid at se lement $7,800.00

704. Earnest deposit retained: $1,300.00

800. Items Payable in Connec on with Loan

801. Our origina on charge

802. Your credit or charge (points) for the specific interest rate chosen

803. Appraisal fee

804. Credit report

805. Tax service

806. Flood cer fica on

807.

808.

809.

810.

900. Items Required by Lender to be Paid in Advance

901. Daily interest charges from 05/06/2020 to 06/01/2020

902. Mortgage insurance premium

903. Homeowner's insurance

904.

1000. Reserves Deposited with Lender

1001. Ini al deposit for your escrow account

1002. Homeowner's insurance

1003. Mortgage insurance

1004. Property taxes

1005.

1006.

1007. Aggregate Adjustment $0.00

1100. Title Charges

1101. Se lement or closing fee to The Bellamy Law Firm $475.00 $475.00

1102. Owner's tle insurance to Chicago Title Insurance Company $471.60

1103. Lender's tle insurance to Chicago Title Insurance Company

1104. Lender's tle policy limit $

1105. Owner's tle policy limit $130,000.00

1106. Title Binder to Coastal Title Services, Inc. $150.00 $150.00

1107. Title Search to The Bellamy Law Firm $175.00 $175.00

1108. Update & Record Fee to Davis Title Service, Inc. $35.00 $35.00

1200. Government Recording and Transfer Charges

1201. Recording fees: Deed $15.00 Mortgage $ Release $ to Horry County Register of Deeds $15.00

1202. City/County tax/stamps Deed $143.00 Mortgage $ to Horry County Register of Deeds $143.00

1203. State tax/stamps Deed $338.00 Mortgage $ to Horry County Register of Deeds $338.00

1204.

1300. Addi onal Se lement Charges

1301. CL‐100 $100.00

1302. Limited Home Warranty $630.00

1303. Cer ficate of Assessment $200.00

1304. Transfer Fee $50.00

1305. 1% Marke ng Fee to Barefoot $1,300.00

1306. May HOA Dues $330.00

1307. June and July HOA Dues $660.00

1308.

1309.

1400. Total Se lement Charges (enter on lines 103, Sec on J and 502, Sec on K) $3,516.60 $9,356.00

See signature addendum

Previous edi ons are obsolete Page 2 of 2 HUD‐1