Page 59 - Inegrated Annual Report 2020-Eng

P. 59

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS | 31 DECEMBER 2020

Subsequent costs

The cost of replacing a part of an item of property, plant and equipment is recognised in the carrying amount of

the item if it is probable that the future economic benefits embodied within the part will flow to the Group and its

cost can be measured reliably. Vessel overhaul and dry-docking costs are capitalised as a separate component

of dredgers when incurred. The costs of day to day servicing of property, plant and equipment are recognised in

the consolidated statement of profit or loss as incurred.

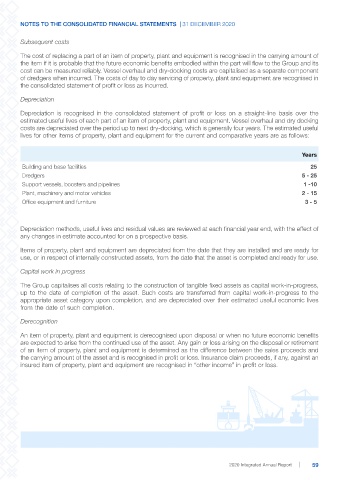

Depreciation

Depreciation is recognised in the consolidated statement of profit or loss on a straight-line basis over the

estimated useful lives of each part of an item of property, plant and equipment. Vessel overhaul and dry docking

costs are depreciated over the period up to next dry-docking, which is generally four years. The estimated useful

lives for other items of property, plant and equipment for the current and comparative years are as follows:

Years

Building and base facilities 25

Dredgers 5 - 25

Support vessels, boosters and pipelines 1 -10

Plant, machinery and motor vehicles 2 - 15

Office equipment and furniture 3 - 5

Depreciation methods, useful lives and residual values are reviewed at each financial year end, with the effect of

any changes in estimate accounted for on a prospective basis.

Items of property, plant and equipment are depreciated from the date that they are installed and are ready for

use, or in respect of internally constructed assets, from the date that the asset is completed and ready for use.

Capital work in progress

The Group capitalises all costs relating to the construction of tangible fixed assets as capital work-in-progress,

up to the date of completion of the asset. Such costs are transferred from capital work-in-progress to the

appropriate asset category upon completion, and are depreciated over their estimated useful economic lives

from the date of such completion.

Derecognition

An item of property, plant and equipment is derecognised upon disposal or when no future economic benefits

are expected to arise from the continued use of the asset. Any gain or loss arising on the disposal or retirement

of an item of property, plant and equipment is determined as the difference between the sales proceeds and

the carrying amount of the asset and is recognised in profit or loss. Insurance claim proceeds, if any, against an

insured item of property, plant and equipment are recognised in “other income” in profit or loss.

2020 Integrated Annual Report 59