Page 63 - Inegrated Annual Report 2020-Eng

P. 63

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS | 31 DECEMBER 2020

Short-term leases and leases of low-value assets

The Group applies the short-term lease recognition exemption to its short-term leases of machinery and

equipment (i.e., those leases that have a lease term of 12 months or less from the commencement date and do

not contain a purchase option). It also applies the lease of low-value assets recognition exemption to leases of

office equipment that are considered of low value. Lease payments on short- term leases and leases of low-value

assets are recognised as expense on a straight-line basis over the lease term.

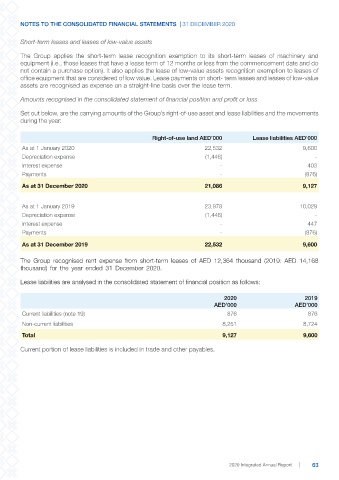

Amounts recognised in the consolidated statement of financial position and profit or loss

Set out below, are the carrying amounts of the Group’s right-of-use asset and lease liabilities and the movements

during the year:

Right-of-use land AED’000 Lease liabilities AED’000

As at 1 January 2020 22,532 9,600

Depreciation expense (1,446) -

Interest expense - 403

Payments - (876)

As at 31 December 2020 21,086 9,127

As at 1 January 2019 23,978 10,029

Depreciation expense (1,446) -

Interest expense - 447

Payments - (876)

As at 31 December 2019 22,532 9,600

The Group recognised rent expense from short-term leases of AED 12,364 thousand (2019: AED 14,168

thousand) for the year ended 31 December 2020.

Lease liabilities are analysed in the consolidated statement of financial position as follows:

2020 2019

AED’000 AED’000

Current liabilities (note 19) 876 876

Non-current liabilities 8,251 8,724

Total 9,127 9,600

Current portion of lease liabilities is included in trade and other payables.

2020 Integrated Annual Report 63