Page 75 - Inegrated Annual Report 2020-Eng

P. 75

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS | 31 DECEMBER 2020

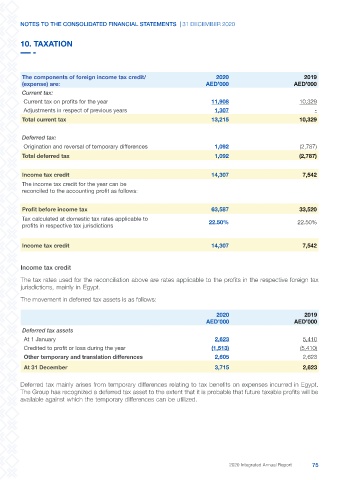

10. TAXATION

The components of foreign income tax credit/ 2020 2019

(expense) are: AED’000 AED’000

Current tax:

Current tax on profits for the year 11,908 10,329

Adjustments in respect of previous years 1,307 -

Total current tax 13,215 10,329

Deferred tax:

Origination and reversal of temporary differences 1,092 (2,787)

Total deferred tax 1,092 (2,787)

Income tax credit 14,307 7,542

The income tax credit for the year can be

reconciled to the accounting profit as follows:

Profit before income tax 63,587 33,520

Tax calculated at domestic tax rates applicable to 22.50%

22.50%

profits in respective tax jurisdictions

Income tax credit 14,307 7,542

Income tax credit

The tax rates used for the reconciliation above are rates applicable to the profits in the respective foreign tax

jurisdictions, mainly in Egypt.

The movement in deferred tax assets is as follows:

2020 2019

AED’000 AED’000

Deferred tax assets

At 1 January 2,623 5,410

Credited to profit or loss during the year (1,513) (5,410)

Other temporary and translation differences 2,605 2,623

At 31 December 3,715 2,623

Deferred tax mainly arises from temporary differences relating to tax benefits on expenses incurred in Egypt.

The Group has recognized a deferred tax asset to the extent that it is probable that future taxable profits will be

available against which the temporary differences can be utilized.

2020 Integrated Annual Report 75