Page 80 - Inegrated Annual Report 2020-Eng

P. 80

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS | 31 DECEMBER 2020

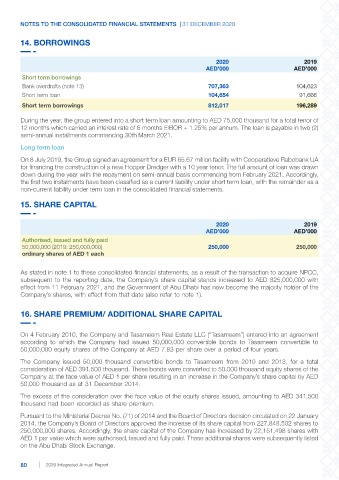

14. BORROWINGS

2020 2019

AED’000 AED’000

Short term borrowings

Bank overdrafts (note 13) 707,363 104,623

Short term loan 104,654 91,666

Short term borrowings 812,017 196,289

During the year, the group entered into a short term loan amounting to AED 75,000 thousand for a total tenor of

12 months which carried an interest rate of 6 months EIBOR + 1.25% per annum. The loan is payable in two (2)

semi-annual installments commencing 30th March 2021.

Long term loan

On 8 July 2019, the Group signed an agreement for a EUR 65.67 million facility with Cooperatieve Rabobank UA

for financing the construction of a new Hopper Dredger with a 10 year tenor. The full amount of loan was drawn

down during the year with the repayment on semi-annual basis commencing from February 2021. Accordingly,

the first two instalments have been classified as a current liability under short term loan, with the remainder as a

non-current liability under term loan in the consolidated financial statements.

15. SHARE CAPITAL

2020 2019

AED’000 AED’000

Authorised, issued and fully paid

50,000,000 (2019: 250,000,000) 250,000 250,000

ordinary shares of AED 1 each

As stated in note 1 to these consolidated financial statements, as a result of the transaction to acquire NPCC,

subsequent to the reporting date, the Company’s share capital stands increased to AED 825,000,000 with

effect from 11 February 2021, and the Government of Abu Dhabi has now become the majority holder of the

Company’s shares, with effect from that date (also refer to note 1).

16. SHARE PREMIUM/ ADDITIONAL SHARE CAPITAL

On 4 February 2010, the Company and Tasameem Real Estate LLC (“Tasameem”) entered into an agreement

according to which the Company had issued 50,000,000 convertible bonds to Tasameem convertible to

50,000,000 equity shares of the Company at AED 7.83 per share over a period of four years.

The Company issued 50,000 thousand convertible bonds to Tasameem from 2010 and 2013, for a total

consideration of AED 391,500 thousand. These bonds were converted to 50,000 thousand equity shares of the

Company at the face value of AED 1 per share resulting in an increase in the Company’s share capital by AED

50,000 thousand as at 31 December 2014.

The excess of the consideration over the face value of the equity shares issued, amounting to AED 341,500

thousand had been recorded as share premium.

Pursuant to the Ministerial Decree No. (71) of 2014 and the Board of Directors decision circulated on 22 January

2014, the Company’s Board of Directors approved the increase of its share capital from 227,848,502 shares to

250,000,000 shares. Accordingly, the share capital of the Company has increased by 22,151,498 shares with

AED 1 par value which were authorised, issued and fully paid. These additional shares were subsequently listed

on the Abu Dhabi Stock Exchange.

80 2020 Integrated Annual Report