Page 79 - Inegrated Annual Report 2020-Eng

P. 79

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS | 31 DECEMBER 2020

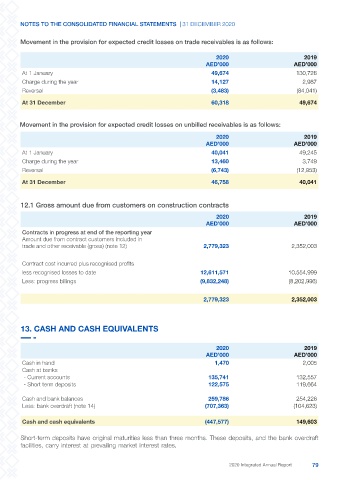

Movement in the provision for expected credit losses on trade receivables is as follows:

2020 2019

AED’000 AED’000

At 1 January 49,674 130,728

Charge during the year 14,127 2,987

Reversal (3,483) (84,041)

At 31 December 60,318 49,674

Movement in the provision for expected credit losses on unbilled receivables is as follows:

2020 2019

AED’000 AED’000

At 1 January 40,041 49,245

Charge during the year 13,460 3,749

Reversal (6,743) (12,953)

At 31 December 46,758 40,041

12.1 Gross amount due from customers on construction contracts

2020 2019

AED’000 AED’000

Contracts in progress at end of the reporting year

Amount due from contract customers included in

trade and other receivable (gross) (note 12) 2,779,323 2,352,003

Contract cost incurred plus recognised profits

less recognised losses to date 12,611,571 10,554,999

Less: progress billings (9,832,248) (8,202,996)

2,779,323 2,352,003

13. CASH AND CASH EQUIVALENTS

2020 2019

AED’000 AED’000

Cash in hand 1,470 2,005

Cash at banks

- Current accounts 135,741 132,557

- Short term deposits 122,575 119,664

Cash and bank balances 259,786 254,226

Less: bank overdraft (note 14) (707,363) (104,623)

Cash and cash equivalents (447,577) 149,603

Short-term deposits have original maturities less than three months. These deposits, and the bank overdraft

facilities, carry interest at prevailing market interest rates.

2020 Integrated Annual Report 79