Page 87 - Inegrated Annual Report 2020-Eng

P. 87

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS | 31 DECEMBER 2020

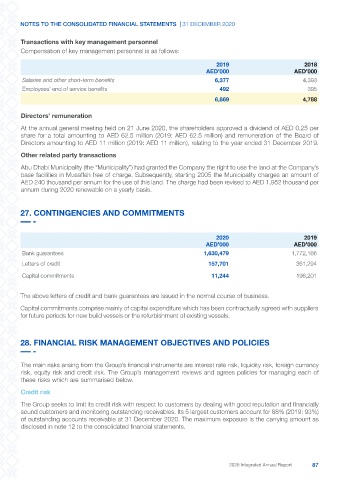

Transactions with key management personnel

Compensation of key management personnel is as follows:

2019 2018

AED’000 AED’000

Salaries and other short-term benefits 6,377 4,393

Employees’ end of service benefits 492 395

6,869 4,788

Directors’ remuneration

At the annual general meeting held on 21 June 2020, the shareholders approved a dividend of AED 0.25 per

share for a total amounting to AED 62.5 million (2019: AED 62.5 million) and remuneration of the Board of

Directors amounting to AED 11 million (2019: AED 11 million), relating to the year ended 31 December 2019.

Other related party transactions

Abu Dhabi Municipality (the “Municipality”) had granted the Company the right to use the land at the Company’s

base facilities in Musaffah free of charge. Subsequently, starting 2005 the Municipality charges an amount of

AED 240 thousand per annum for the use of this land. The charge had been revised to AED 1,952 thousand per

annum during 2020 renewable on a yearly basis.

27. CONTINGENCIES AND COMMITMENTS

2020 2019

AED’000 AED’000

Bank guarantees 1,630,479 1,772,166

Letters of credit 157,701 361,294

Capital commitments 11,244 196,201

The above letters of credit and bank guarantees are issued in the normal course of business.

Capital commitments comprise mainly of capital expenditure which has been contractually agreed with suppliers

for future periods for new build vessels or the refurbishment of existing vessels.

28. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

The main risks arising from the Group’s financial instruments are interest rate risk, liquidity risk, foreign currency

risk, equity risk and credit risk. The Group’s management reviews and agrees policies for managing each of

these risks which are summarised below.

Credit risk

The Group seeks to limit its credit risk with respect to customers by dealing with good reputation and financially

sound customers and monitoring outstanding receivables. Its 5 largest customers account for 88% (2019: 93%)

of outstanding accounts receivable at 31 December 2020. The maximum exposure is the carrying amount as

disclosed in note 12 to the consolidated financial statements.

2020 Integrated Annual Report 87