Page 89 - Inegrated Annual Report 2020-Eng

P. 89

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS | 31 DECEMBER 2020

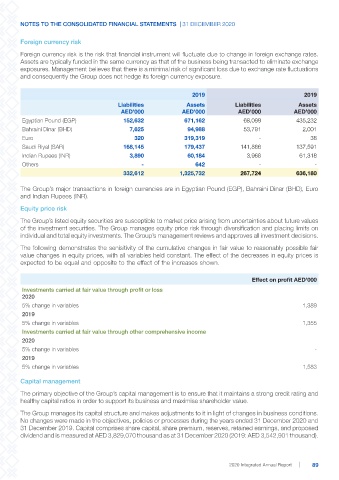

Foreign currency risk

Foreign currency risk is the risk that financial instrument will fluctuate due to change in foreign exchange rates.

Assets are typically funded in the same currency as that of the business being transacted to eliminate exchange

exposures. Management believes that there is a minimal risk of significant loss due to exchange rate fluctuations

and consequently the Group does not hedge its foreign currency exposure.

2019 2019

Liabilities Assets Liabilities Assets

AED’000 AED’000 AED’000 AED’000

Egyptian Pound (EGP) 152,632 671,162 68,099 435,232

Bahraini Dinar (BHD) 7,625 94,988 53,791 2,001

Euro 320 319,319 - 38

Saudi Riyal (SAR) 168,145 179,437 141,866 137,591

Indian Rupees (INR) 3,890 60,184 3,968 61,318

Others - 642 - -

332,612 1,325,732 267,724 636,180

The Group’s major transactions in foreign currencies are in Egyptian Pound (EGP), Bahraini Dinar (BHD), Euro

and Indian Rupees (INR).

Equity price risk

The Group’s listed equity securities are susceptible to market price arising from uncertainties about future values

of the investment securities. The Group manages equity price risk through diversification and placing limits on

individual and total equity investments. The Group’s management reviews and approves all investment decisions.

The following demonstrates the senisitivity of the cumulative changes in fair value to reasonably possible fair

value changes in equity prices, with all variables held constant. The effect of the decreases in equity prices is

expected to be equal and opposite to the effect of the increases shown.

Effect on profit AED’000

Investments carried at fair value through profit or loss

2020

5% change in variables 1,389

2019

5% change in variables 1,355

Investments carried at fair value through other comprehensive income

2020

5% change in variables -

2019

5% change in variables 1,583

Capital management

The primary objective of the Group’s capital management is to ensure that it maintains a strong credit rating and

healthy capital ratios in order to support its business and maximise shareholder value.

The Group manages its capital structure and makes adjustments to it in light of changes in business conditions.

No changes were made in the objectives, policies or processes during the years ended 31 December 2020 and

31 December 2019. Capital comprises share capital, share premium, reserves, retained earnings, and proposed

dividend and is measured at AED 3,829,070 thousand as at 31 December 2020 (2019: AED 3,542,901 thousand).

2020 Integrated Annual Report 89