Page 88 - Inegrated Annual Report 2020-Eng

P. 88

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS | 31 DECEMBER 2020

With respect to credit risk arising from the other financial assets of the Group, including cash and cash equivalents,

the Group’s exposure to credit risk arises from default of the counterparty, with a maximum exposure equal to the

carrying amount of these instruments. The Group manages its credit risk with respect to banks by only dealing

with reputable banks..

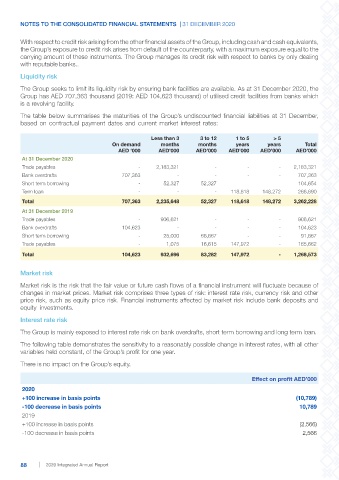

Liquidity risk

The Group seeks to limit its liquidity risk by ensuring bank facilities are available. As at 31 December 2020, the

Group has AED 707,363 thousand (2019: AED 104,623 thousand) of utilised credit facilities from banks which

is a revolving facility.

The table below summarises the maturities of the Group’s undiscounted financial liabilities at 31 December,

based on contractual payment dates and current market interest rates:

Less than 3 3 to 12 1 to 5 > 5

On demand months months years years Total

AED ‘000 AED’000 AED’000 AED’000 AED’000 AED’000

At 31 December 2020

Trade payables - 2,183,321 - - - 2,183,321

Bank overdrafts 707,363 - - - - 707,363

Short term borrowing - 52,327 52,327 104,654

Term loan - - - 118,618 148,272 266,890

Total 707,363 2,235,648 52,327 118,618 148,272 3,262,228

At 31 December 2019

Trade payables - 906,621 - - - 906,621

Bank overdrafts 104,623 - - - - 104,623

Short term borrowing - 25,000 66,667 - - 91,667

Trade payables - 1,075 16,615 147,972 - 165,662

Total 104,623 932,696 83,282 147,972 - 1,268,573

Market risk

Market risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of

changes in market prices. Market risk comprises three types of risk: interest rate risk, currency risk and other

price risk, such as equity price risk. Financial instruments affected by market risk include bank deposits and

equity investments.

Interest rate risk

The Group is mainly exposed to interest rate risk on bank overdrafts, short term borrowing and long term loan.

The following table demonstrates the sensitivity to a reasonably possible change in interest rates, with all other

variables held constant, of the Group’s profit for one year.

There is no impact on the Group’s equity.

Effect on profit AED’000

2020

+100 increase in basis points (10,789)

-100 decrease in basis points 10,789

2019

+100 increase in basis points (2,566)

-100 decrease in basis points 2,566

88 2020 Integrated Annual Report