Page 5 - AB Mauri 2022 Benefits Guide MOIL

P. 5

2022 Benefits Enrollment

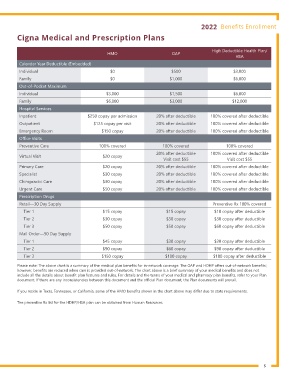

Cigna Medical and Prescription Plans

High Deductible Health Plan/

HMO OAP

HSA

Calendar Year Deductible (Embedded)

Individual $0 $500 $3,000

Family $0 $1,000 $6,000

Out-of-Pocket Maximum

Individual $3,000 $1,500 $6,000

Family $6,000 $3,000 $12,000

Hospital Services

Inpatient $250 copay per admission 20% after deductible 100% covered after deductible

Outpatient $125 copay per visit 20% after deductible 100% covered after deductible

Emergency Room $150 copay 20% after deductible 100% covered after deductible

Oice Visits

Preventive Care 100% covered 100% covered 100% covered

20% after deductible 100% covered after deductible

Virtual Visit $20 copay

Visit cost $55 Visit cost $55

Primary Care $20 copay 20% after deductible 100% covered after deductible

Specialist $30 copay 20% after deductible 100% covered after deductible

Chiropractic Care $30 copay 20% after deductible 100% covered after deductible

Urgent Care $50 copay 20% after deductible 100% covered after deductible

Prescription Drugs

Retail—30 Day Supply Preventive Rx 100% covered

Tier 1 $15 copay $15 copay $10 copay after deductible

Tier 2 $30 copay $30 copay $30 copay after deductible

Tier 3 $50 copay $50 copay $60 copay after deductible

Mail Order—90 Day Supply

Tier 1 $45 copay $30 copay $30 copay after deductible

Tier 2 $90 copay $60 copay $90 copay after deductible

Tier 3 $150 copay $100 copay $180 copay after deductible

Please note: The above chart is a summary of the medical plan beneits for in-network coverage. The OAP and HDHP ofers out-of-network beneits;

however, beneits are reduced when care is provided out-of-network. The chart above is a brief summary of your medical beneits and does not

include all the details about beneit plan features and rules. For details and the terms of your medical and pharmacy plan beneits, refer to your Plan

document. If there are any inconsistencies between this document and the oicial Plan document, the Plan documents will prevail.

If you reside in Texas, Tennessee, or California, some of the HMO beneits shown in the chart above may difer due to state requirements.

The preventive Rx list for the HDHP/HSA plan can be obtained from Human Resources.

5

Cigna Medical and Prescription Plans

High Deductible Health Plan/

HMO OAP

HSA

Calendar Year Deductible (Embedded)

Individual $0 $500 $3,000

Family $0 $1,000 $6,000

Out-of-Pocket Maximum

Individual $3,000 $1,500 $6,000

Family $6,000 $3,000 $12,000

Hospital Services

Inpatient $250 copay per admission 20% after deductible 100% covered after deductible

Outpatient $125 copay per visit 20% after deductible 100% covered after deductible

Emergency Room $150 copay 20% after deductible 100% covered after deductible

Oice Visits

Preventive Care 100% covered 100% covered 100% covered

20% after deductible 100% covered after deductible

Virtual Visit $20 copay

Visit cost $55 Visit cost $55

Primary Care $20 copay 20% after deductible 100% covered after deductible

Specialist $30 copay 20% after deductible 100% covered after deductible

Chiropractic Care $30 copay 20% after deductible 100% covered after deductible

Urgent Care $50 copay 20% after deductible 100% covered after deductible

Prescription Drugs

Retail—30 Day Supply Preventive Rx 100% covered

Tier 1 $15 copay $15 copay $10 copay after deductible

Tier 2 $30 copay $30 copay $30 copay after deductible

Tier 3 $50 copay $50 copay $60 copay after deductible

Mail Order—90 Day Supply

Tier 1 $45 copay $30 copay $30 copay after deductible

Tier 2 $90 copay $60 copay $90 copay after deductible

Tier 3 $150 copay $100 copay $180 copay after deductible

Please note: The above chart is a summary of the medical plan beneits for in-network coverage. The OAP and HDHP ofers out-of-network beneits;

however, beneits are reduced when care is provided out-of-network. The chart above is a brief summary of your medical beneits and does not

include all the details about beneit plan features and rules. For details and the terms of your medical and pharmacy plan beneits, refer to your Plan

document. If there are any inconsistencies between this document and the oicial Plan document, the Plan documents will prevail.

If you reside in Texas, Tennessee, or California, some of the HMO beneits shown in the chart above may difer due to state requirements.

The preventive Rx list for the HDHP/HSA plan can be obtained from Human Resources.

5