Page 9 - 2015 CBRY Enrollment Guide

P. 9

ASARCO

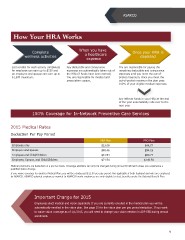

How Your HRA Works

Complete When you have Once your HRA is

wellness activities a healthcare depleted

expense

Earn credits for each activity completed. Any deductible and coinsurance You are responsible for paying the

An employee can earn up to $750 and expenses are automatically taken out of remaining deductible and coinsurance

an employee and spouse can earn up to the HRA (if funds have been earned). expenses until you meet the out-of-

$1,500 maximum. You are responsible for medical and pocket maximum. Once you meet the

prescription copays. out-of-pocket maximum the plan pays

100% of your eligible medical expenses.

Any leftover funds in your HRA at the end

of the year automatically rolls over to the

next year

100% Coverage for In-Network Preventive Care Services

2015 Medical Rates

Deduction Per Pay Period

HRA Plan PPO Plan

Employee only $23.08 $44.77

Employee and Spouse $48.46 $94.15

Employee and Child/Children $41.54 $80.77

Employee, Spouse, and Child/Children $71.54 $149.54

Medical premiums are deducted on a pre-tax basis. Coverage elections can only be changed during Annual Enrollment unless you experience a

qualiied status change.

If you waive coverage for another Medical Plan, you will be reimbursed $12.50 per pay period. Not applicable if both husband and wife are employed

by ASARCO. ASARCO salaried employees married to ASARCO hourly employees are only eligible to elect beneits under the Salaried Beneit Plan.

Important Change for 2015

Employees elect medical and vision separately. If you are currently enrolled in the medical plan you will be

automatically enrolled in the vision plan. See page 15 for the vision plan per pay period deduction. If you want

to waive vision coverage as of 1/1/2015, you will need to change your vision election in ADP ESS during annual

enrollment.

9

How Your HRA Works

Complete When you have Once your HRA is

wellness activities a healthcare depleted

expense

Earn credits for each activity completed. Any deductible and coinsurance You are responsible for paying the

An employee can earn up to $750 and expenses are automatically taken out of remaining deductible and coinsurance

an employee and spouse can earn up to the HRA (if funds have been earned). expenses until you meet the out-of-

$1,500 maximum. You are responsible for medical and pocket maximum. Once you meet the

prescription copays. out-of-pocket maximum the plan pays

100% of your eligible medical expenses.

Any leftover funds in your HRA at the end

of the year automatically rolls over to the

next year

100% Coverage for In-Network Preventive Care Services

2015 Medical Rates

Deduction Per Pay Period

HRA Plan PPO Plan

Employee only $23.08 $44.77

Employee and Spouse $48.46 $94.15

Employee and Child/Children $41.54 $80.77

Employee, Spouse, and Child/Children $71.54 $149.54

Medical premiums are deducted on a pre-tax basis. Coverage elections can only be changed during Annual Enrollment unless you experience a

qualiied status change.

If you waive coverage for another Medical Plan, you will be reimbursed $12.50 per pay period. Not applicable if both husband and wife are employed

by ASARCO. ASARCO salaried employees married to ASARCO hourly employees are only eligible to elect beneits under the Salaried Beneit Plan.

Important Change for 2015

Employees elect medical and vision separately. If you are currently enrolled in the medical plan you will be

automatically enrolled in the vision plan. See page 15 for the vision plan per pay period deduction. If you want

to waive vision coverage as of 1/1/2015, you will need to change your vision election in ADP ESS during annual

enrollment.

9