Page 134 - Business Principles and Management

P. 134

Chapter 5 • Proprietorships and Partnerships

5.3 Partnership

Goals Terms

• Explain advantages and • partnership • unlimited financial

disadvantages of partnerships. • limited partnership liability

• Describe the types of businesses

suited to the partnership form

of business.

The Nature of Partnerships

Jennifer York, who operates the proprietorship mentioned earlier, is faced with

the problem of expanding her business. She has run the business successfully for

over 10 years. She sees new opportunities in the community for increasing her

business, but she does not wish to assume full responsibility for the undertaking.

She realizes that the expansion of the business will entail considerable financial

and managerial responsibilities. She also realizes that in order to expand, she

needs additional capital, but she does not want to borrow the money. Because of

these reasons, she has decided that it would be wise to change her business from

a proprietorship to a partnership, a business owned by two or more people.

Robert Burton operates an adjoining bakery, where he bakes fresh bread and

pastries daily. He has proven to be honest and to have considerable business

ability. Combining the two businesses could result in more customers for both

groceries and fresh baked goods. Customers who have been coming to the bake

shop may become grocery customers also. And those who have been buying at

the grocery and fruit market may become customers of bakery products. A dis-

cussion between York and Burton leads to a tentative agreement to form a part-

nership if a third person can be found who will invest enough cash to remodel

both stores to form one large store and to purchase additional equipment. The

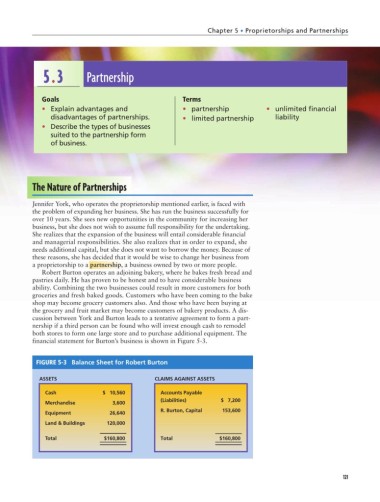

financial statement for Burton’s business is shown in Figure 5-3.

FIGURE 5-3 Balance Sheet for Robert Burton

ASSETS CLAIMS AGAINST ASSETS

Cash $ 10,560 Accounts Payable

(Liabilities) $ 7,200

Merchandise 3,600

R. Burton, Capital 153,600

Equipment 26,640

Land & Buildings 120,000

Total $160,800 Total $160,800

121