Page 449 - Business Principles and Management

P. 449

Unit 5

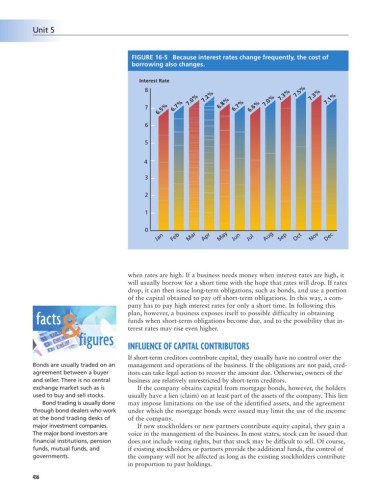

FIGURE 16-5 Because interest rates change frequently, the cost of

borrowing also changes.

Interest Rate

8 7.2% 7.3% 7.5% 7.3% 7.1%

6.5%

7 6.7% 7.0% 6.8% 6.7% 6.6% 7.0%

6

5

4

3

2

1

0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

when rates are high. If a business needs money when interest rates are high, it

will usually borrow for a short time with the hope that rates will drop. If rates

drop, it can then issue long-term obligations, such as bonds, and use a portion

of the capital obtained to pay off short-term obligations. In this way, a com-

pany has to pay high interest rates for only a short time. In following this

facts & plan, however, a business exposes itself to possible difficulty in obtaining

funds when short-term obligations become due, and to the possibility that in-

terest rates may rise even higher.

figures

INFLUENCE OF CAPITAL CONTRIBUTORS

If short-term creditors contribute capital, they usually have no control over the

Bonds are usually traded on an management and operations of the business. If the obligations are not paid, cred-

agreement between a buyer itors can take legal action to recover the amount due. Otherwise, owners of the

and seller. There is no central business are relatively unrestricted by short-term creditors.

exchange market such as is If the company obtains capital from mortgage bonds, however, the holders

used to buy and sell stocks. usually have a lien (claim) on at least part of the assets of the company. This lien

Bond trading is usually done may impose limitations on the use of the identified assets, and the agreement

through bond dealers who work under which the mortgage bonds were issued may limit the use of the income

at the bond trading desks of of the company.

major investment companies. If new stockholders or new partners contribute equity capital, they gain a

The major bond investors are voice in the management of the business. In most states, stock can be issued that

financial institutions, pension does not include voting rights, but that stock may be difficult to sell. Of course,

funds, mutual funds, and if existing stockholders or partners provide the additional funds, the control of

governments. the company will not be affected as long as the existing stockholders contribute

in proportion to past holdings.

436