Page 450 - Business Principles and Management

P. 450

Chapter 16 • Financing a Business

If the company increases the number of shares of stock by selling new shares,

it must share earnings with a greater number of shareholders. For example, when

the number of shareholders increases from 2,000 to 2,500, the distribution of

$130,000 in dividends changes from $65 per share ($130,000/2,000) to $52 per

share ($130,000/2,500). The original owners may not wish to give up any of

their profits or voice in management unless it is profitable to do so. An increase

in shareholders would need to be offset by an increase in earnings.

CHECKPOINT

What can a business do to obtain capital when faced with high

interest rates?

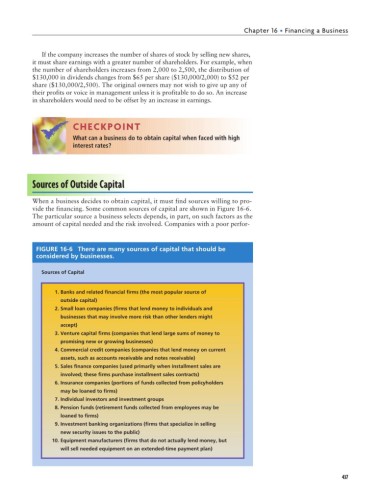

Sources of Outside Capital

When a business decides to obtain capital, it must find sources willing to pro-

vide the financing. Some common sources of capital are shown in Figure 16-6.

The particular source a business selects depends, in part, on such factors as the

amount of capital needed and the risk involved. Companies with a poor perfor-

FIGURE 16-6 There are many sources of capital that should be

considered by businesses.

Sources of Capital

1. Banks and related financial firms (the most popular source of

outside capital)

2. Small loan companies (firms that lend money to individuals and

businesses that may involve more risk than other lenders might

accept)

3. Venture capital firms (companies that lend large sums of money to

promising new or growing businesses)

4. Commercial credit companies (companies that lend money on current

assets, such as accounts receivable and notes receivable)

5. Sales finance companies (used primarily when installment sales are

involved; these firms purchase installment sales contracts)

6. Insurance companies (portions of funds collected from policyholders

may be loaned to firms)

7. Individual investors and investment groups

8. Pension funds (retirement funds collected from employees may be

loaned to firms)

9. Investment banking organizations (firms that specialize in selling

new security issues to the public)

10. Equipment manufacturers (firms that do not actually lend money, but

will sell needed equipment on an extended-time payment plan)

437