Page 446 - Business Principles and Management

P. 446

Chapter 16 • Financing a Business

and personal credit cards. Normally, businesses have to pay the interest due on the

loan monthly and may have a specific payment schedule for the principal as well.

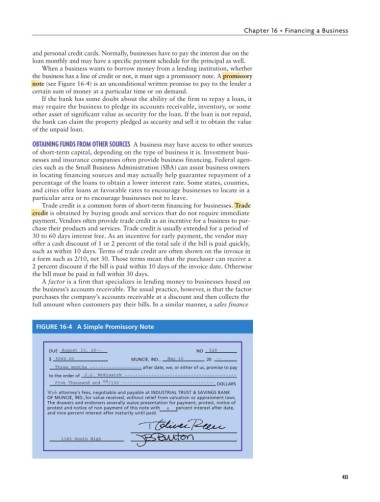

When a business wants to borrow money from a lending institution, whether

the business has a line of credit or not, it must sign a promissory note. A promissory

note (see Figure 16-4) is an unconditional written promise to pay to the lender a

certain sum of money at a particular time or on demand.

If the bank has some doubt about the ability of the firm to repay a loan, it

may require the business to pledge its accounts receivable, inventory, or some

other asset of significant value as security for the loan. If the loan is not repaid,

the bank can claim the property pledged as security and sell it to obtain the value

of the unpaid loan.

OBTAINING FUNDS FROM OTHER SOURCES A business may have access to other sources

of short-term capital, depending on the type of business it is. Investment busi-

nesses and insurance companies often provide business financing. Federal agen-

cies such as the Small Business Administration (SBA) can assist business owners

in locating financing sources and may actually help guarantee repayment of a

percentage of the loans to obtain a lower interest rate. Some states, counties,

and cities offer loans at favorable rates to encourage businesses to locate in a

particular area or to encourage businesses not to leave.

Trade credit is a common form of short-term financing for businesses. Trade

credit is obtained by buying goods and services that do not require immediate

payment. Vendors often provide trade credit as an incentive for a business to pur-

chase their products and services. Trade credit is usually extended for a period of

30 to 60 days interest free. As an incentive for early payment, the vendor may

offer a cash discount of 1 or 2 percent of the total sale if the bill is paid quickly,

such as within 10 days. Terms of trade credit are often shown on the invoice in

a form such as 2/10, net 30. Those terms mean that the purchaser can receive a

2 percent discount if the bill is paid within 10 days of the invoice date. Otherwise

the bill must be paid in full within 30 days.

A factor is a firm that specializes in lending money to businesses based on

the business’s accounts receivable. The usual practice, however, is that the factor

purchases the company’s accounts receivable at a discount and then collects the

full amount when customers pay their bills. In a similar manner, a sales finance

FIGURE 16-4 A Simple Promissory Note

DUE August 10, 20-- NO 528

$ 5000.00 MUNCIE, IND., May 10 , 20 --

Three months -------------------

after date, we, or either of us, promise to pay

to the order of J.J. McKissick ------------------------------------------

00

Five Thousand and

/100 ----------------------------------

DOLLARS

With attorney’s fees, negotiable and payable at INDUSTRIAL TRUST & SAVINGS BANK

OF MUNCIE, IND.,for value received, without relief from valuation or appraisment laws.

The drawers and endorsers severally waive presentation for payment, protest, notice of

8

protest and notice of non payment of this note with percent interest after date,

and nine percent interest after maturity until paid.

1145 South High

433