Page 461 - Business Principles and Management

P. 461

Unit 5

institution. Although nonbank financial institutions initially developed to offer

financial products such as insurance and investments, they have increasingly be-

gun to offer services traditionally reserved for banks. As you will discover, the

distinction between banks and nonbanks is fading fast.

TYPES OF BANKS

Banks are often known as deposit institutions because their customers deposit ex-

cess funds for the purpose of earning interest on the deposits. Depending on the

type of institution, deposits are accepted from individual consumers, businesses,

and local, state, and national governments. The banks use those deposits to make

loans to customers who need additional financial resources for short or long peri-

ods of time. Those customers pay interest to the bank for the use of the funds. The

bank accepts the risk that the loan may not be repaid. They take steps to reduce

the risk by carefully evaluating loan customers and spreading the risk across a

large number of loans.

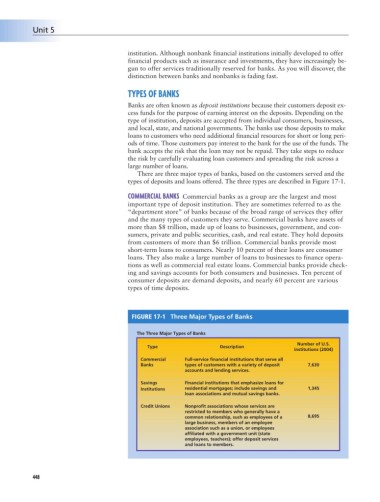

There are three major types of banks, based on the customers served and the

types of deposits and loans offered. The three types are described in Figure 17-1.

COMMERCIAL BANKS Commercial banks as a group are the largest and most

important type of deposit institution. They are sometimes referred to as the

“department store” of banks because of the broad range of services they offer

and the many types of customers they serve. Commercial banks have assets of

more than $8 trillion, made up of loans to businesses, government, and con-

sumers, private and public securities, cash, and real estate. They hold deposits

from customers of more than $6 trillion. Commercial banks provide most

short-term loans to consumers. Nearly 10 percent of their loans are consumer

loans. They also make a large number of loans to businesses to finance opera-

tions as well as commercial real estate loans. Commercial banks provide check-

ing and savings accounts for both consumers and businesses. Ten percent of

consumer deposits are demand deposits, and nearly 60 percent are various

types of time deposits.

FIGURE 17-1 Three Major Types of Banks

The Three Major Types of Banks

Number of U.S.

Type Description

institutions (2004)

Commercial Full-service financial institutions that serve all

Banks types of customers with a variety of deposit 7,630

accounts and lending services.

Savings Financial institutions that emphasize loans for

Institutions residential mortgages; include savings and 1,345

loan associations and mutual savings banks.

Credit Unions Nonprofit associations whose services are

restricted to members who generally have a

common relationship, such as employees of a 8,695

large business, members of an employee

association such as a union, or employees

affiliated with a government unit (state

employees, teachers); offer deposit services

and loans to members.

448