Page 490 - Business Principles and Management

P. 490

Chapter 18 • Credit and Insurance

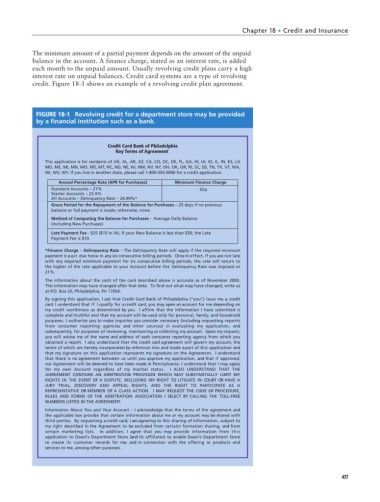

The minimum amount of a partial payment depends on the amount of the unpaid

balance in the account. A finance charge, stated as an interest rate, is added

each month to the unpaid amount. Usually revolving credit plans carry a high

interest rate on unpaid balances. Credit card systems are a type of revolving

credit. Figure 18-1 shows an example of a revolving credit plan agreement.

FIGURE 18-1 Revolving credit for a department store may be provided

by a financial institution such as a bank.

Credit Card Bank of Philadelphia

Key Terms of Agreement

This application is for residents of AK, AL, AR, AZ, CA, CO, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, LA

MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NJ, NM, NV, NY, OH, OK, OR, RI, SC, SD, TN, TX, UT, WA,

WI, WV, WY. If you live in another state, please call 1-800-555-0000 for a credit application.

Annual Percentage Rate (APR for Purchases) Minimum Finance Charge

Standard Accounts – 21% 50¢

Starter Accounts – 23.9%

All Accounts – Delinquency Rate – 24.99%*

Grace Period for the Repayment of the Balance for Purchases – 25 days if no previous

balance or full payment is made; otherwise, none.

Method of Computing the Balance for Purchases – Average Daily Balance

(including New Purchases)

Late Payment Fee - $25 ($15 in IA). If your New Balance is less than $50, the Late

Payment Fee is $10.

*Finance Charge – Delinquency Rate – The Delinquency Rate will apply if the required minimum

payment is past due twice in any six consecutive billing periods. Once in effect, if you are not late

with any required minimum payment for six consecutive billing periods, the rate will return to

the higher of the rate applicable to your Account before the Delinquency Rate was imposed or

21%.

The information about the costs of the card described above is accurate as of November 2000.

This information may have changed after that date. To find out what may have changed, write us

at P.O. Box 25, Philadelphia, PA 17054.

By signing this application, I ask that Credit Card Bank of Philadelphia (“you”) issue me a credit

card. I understand that if I qualify for a credit card, you may open an account for me depending on

my credit worthiness as determined by you. I affirm that the information I have submitted is

complete and truthful and that my account will be used only for personal, family, and household

purposes. I authorize you to make inquiries you consider necessary (including requesting reports

from consumer reporting agencies and other sources) in evaluating my application, and

subsequently, for purposes of reviewing, maintaining or collecting my account. Upon my request,

you will advise me of the name and address of each consumer reporting agency from which you

obtained a report. I also understand that the credit card agreement will govern my account, the

terms of which are hereby incorporated by reference into and made a part of this application and

that my signature on this application represents my signature on the Agreement. I understand

that there is no agreement between us until you approve my application, and that if approved,

our Agreement will be deemed to have been made in Pennsylvania. I understand that I may apply

for my own Account regardless of my marital status. I ALSO UNDERSTAND THAT THE

AGREEMENT CONTAINS AN ARBITRATION PROVISION WHICH MAY SUBSTANTIALLY LIMIT MY

RIGHTS IN THE EVENT OF A DISPUTE, INCLUDING MY RIGHT TO LITIGATE IN COURT OR HAVE A

JURY TRIAL, DISCOVERY AND APPEAL RIGHTS, AND THE RIGHT TO PARTICIPATE AS A

REPRESENTATIVE OR MEMBER OF A CLASS ACTION. I MAY REQUEST THE CODE OF PROCEDURE,

RULES AND FORMS OF THE ARBITRATION ASSOCIATION I SELECT BY CALLING THE TOLL-FREE

NUMBERS LISTED IN THE AGREEMENT.

Information About You and Your Account – I acknowledge that the terms of the agreement and

the applicable law provide that certain information about me or my account may be shared with

third parties. By requesting a credit card, I am agreeing to this sharing of information, subject to

my right described in the Agreement to be excluded from certaini formation sharing, and from

certain marketing lists. In addition, I agree that you may provide information from this

application to Dawn’s Department Store (and its affiliates) to enable Dawn’s Department Store

to create its customer records for me, and in connection with the offering or products and

services to me, among other purposes.

477