Page 499 - Business Principles and Management

P. 499

Unit 5

accounts receivable are gradually growing larger each month, then the company

is not collecting payments from customers quickly enough. Soon, the company

may not have enough cash to pay its own bills. Before accounts receivable get

too large, the company must take action to collect accounts more efficiently.

The total accounts receivable may not show the true picture. For instance,

an analysis may show that most of the overdue accounts are only 30 or 60

days overdue, with only a few 90 days or more overdue. In this situation, the

problem lies with just a few customers. The company can take aggressive ac-

tion toward those customers and may not have to change overall collection

policies. On the other hand, if an analysis of the accounts receivable record

shows that most of the late accounts are 90 days or more overdue, the collec-

tion problem is more pervasive. In this case, the company may have to take

stronger action to determine the reason so many customers are not paying

their accounts.

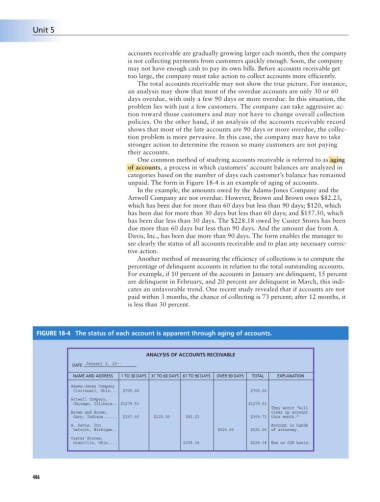

One common method of studying accounts receivable is referred to as aging

of accounts, a process in which customers’ account balances are analyzed in

categories based on the number of days each customer’s balance has remained

unpaid. The form in Figure 18-4 is an example of aging of accounts.

In the example, the amounts owed by the Adams-Jones Company and the

Artwell Company are not overdue. However, Brown and Brown owes $82.23,

which has been due for more than 60 days but less than 90 days; $120, which

has been due for more than 30 days but less than 60 days; and $157.50, which

has been due less than 30 days. The $228.18 owed by Custer Stores has been

due more than 60 days but less than 90 days. And the amount due from A.

Davis, Inc., has been due more than 90 days. The form enables the manager to

see clearly the status of all accounts receivable and to plan any necessary correc-

tive action.

Another method of measuring the efficiency of collections is to compute the

percentage of delinquent accounts in relation to the total outstanding accounts.

For example, if 10 percent of the accounts in January are delinquent, 15 percent

are delinquent in February, and 20 percent are delinquent in March, this indi-

cates an unfavorable trend. One recent study revealed that if accounts are not

paid within 3 months, the chance of collecting is 73 percent; after 12 months, it

is less than 30 percent.

FIGURE 18-4 The status of each account is apparent through aging of accounts.

ANALYSIS OF ACCOUNTS RECEIVABLE

January 2, 20--

DATE

NAME AND ADDRESS 1 TO 30 DAYS 31 TO 60 DAYS 61 TO 90 DAYS OVER 90 DAYS TOTAL EXPLANATION

Adams-Jones Company

Cincinnati, Ohio... $705.00 $705.00

Artwell Company,

Chicago, Illinois.. $1279.53 $1279.53

They wrote “will

Brown and Brown, clear up account

Gary, Indiana...... $157.50 $120.00 $82.23 $359.73 this month.”

A. Davis, Inc. Account in hands

Detroit, Michigan.. $525.00 $525.00 of attorney.

Custer Stores,

Granville, Ohio.... $228.18 $228.18 Now on COD basis.

486