Page 15 - CCFA Journal - Ninth Issue

P. 15

加中金融 市场展望 Market Outlook

市场展望 Market Outlook

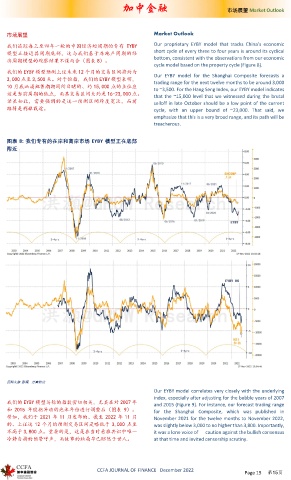

我们追踪每三至四年一轮的中国经济短周期的专有 EYBY Our proprietary EYBY model that tracks China’s economic

模型正接近其周期底部,这与我们基于房地产周期的经 short cycle of every three to four years is around its cyclical

济周期模型的观察结果不谋而合(图表 8)。 bottom, consistent with the observations from our economic

cycle model based on the property cycle (Figure 8).

我们的 EYBY 模型预测上证未来 12 个月的交易区间将约为 Our EYBY model for the Shanghai Composite forecasts a

3,000 点至 3,500 点。对于恒指,我们的 EYBY 模型表明, trading range for the next twelve months to be around 3,000

10 月底汹涌抛售潮期间所目睹的、约 15,000 点的点位应 to ~3,500. For the Hang Seng Index, our EYBY model indicates

该是当前周期的低点,而其交易区间大约是 16-23,000 点。 that the ~15,000 level that we witnessed during the brutal

话虽如此,需要强调的是这一预测区间跨度宽泛,而前 selloff in late October should be a low point of the current

路将是荆棘载途。 cycle, with an upper bound of ~23,000. That said, we

emphasize that this is a very broad range, and its path will be

treacherous.

图表 8: 我们专有的在岸和离岸市场 EYBY 模型正在底部

附近

资料来源 : 彭博,思睿研究

Our EYBY model correlates very closely with the underlying

index, especially after adjusting for the bubble years of 2007

我们的 EYBY 模型与标的指数密切相关,尤其在对 2007 年 and 2015 (Figure 9). For instance, our forecast trading range

和 2015 年股指异动的泡沫年份进行调整后(图表 9)。 for the Shanghai Composite, which was published in

譬如,我们于 2021 年 11 月发布的、截至 2022 年 11 月 November 2021 for the twelve months to November 2022,

的、上证这 12 个月的预测交易区间是略低于 3,000 点至 was slightly below 3,000 to no higher than 3,800. Importantly,

不高于 3,800 点。重要的是,这是在当时看涨共识中唯一 it was a lone voice of caution against the bullish consensus

冷静自持的预警呼声,而故事的结局早已昭然于世人。 at that time and invited censorship scrutiny.

CCFA JOURNAL OF FINANCE December 2022

Page 15 第15页