Page 11 - CCFA Journal - Ninth Issue

P. 11

加中金融 市场展望 Market Outlook

中国经济短周期临近转折点。然而… China’s Short Economic Cycle Near Turning Point.

But…

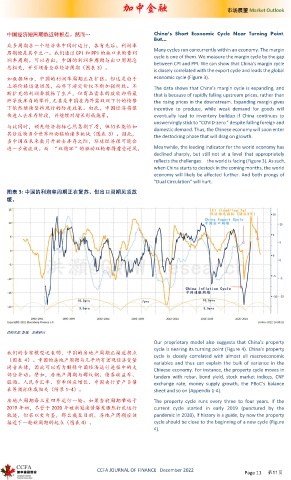

众多周期在一个经济体中同时运行,各有先后。利润率

周期便是其中之一。我们通过 CPI 和 PPI 的缺口来衡量利 Many cycles run concurrently within an economy. The margin

cycle is one of them. We measure the margin cycle by the gap

润率周期。可以看出,中国的利润率周期与出口周期息 between CPI and PPI. We can show that China’s margin cycle

息相关,并引领着全球经济周期(图表 3)。 is closely correlated with the export cycle and leads the global

如数据所示,中国的利润率周期正在扩张。但这是由于 economic cycle (Figure 3).

上游价格迅速回落,而非下游定价权不断加强所致。不 The data shows that China’s margin cycle is expanding, and

断扩充的利润率提振了生产,但商品需求的疲软却将最 that is because of rapidly falling upstream prices, rather than

终导致库存的攀升,尤其是中国在内外需双双下行的情势 the rising prices in the downstream. Expanding margin gives

下依然继续坚持现行的防疫政策。由此,中国经济将很 incentive to produce, while weak demand for goods will

快进入去库存阶段,并继续对增长形成拖累。 eventually lead to inventory buildup if China continues to

unswervingly stick to “COVID-zero ” despite falling foreign and

与此同时,领先经济指标已然急剧下滑,但仍未能恰如 domestic demand. Thus, the Chinese economy will soon enter

其分反映当今世界所面临的诸多挑战(图表 3)。因此, the destocking phase that will drag on growth.

当中国在未来数月开始去库存之际,环球经济很可能会

进一步被波及。而 “双循环”的驱动双轮都将遭受逆风。 Meanwhile, the leading indicator for the world economy has

declined sharply, but still not at a level that appropriately

reflects the challenges the world is facing (Figure 3). As such,

when China starts to destock in the coming months, the world

economy will likely be affected further. And both prongs of

“Dual Circulation” will hurt.

图表 3: 中国的利润率周期正在复苏,但出口周期见顶放

缓。

资料来源 : 彭博,思睿研究

Our proprietary model also suggests that China’s property

cycle is nearing its turning point (Figure 4). China’s property

我们的专有模型还表明,中国的房地产周期正接近拐点 cycle is closely correlated with almost all macroeconomic

(图表 4)。中国的房地产周期与几乎所有宏观经济变量 variables and thus can explain the bulk of variance in the

同音共律,因此可以有力解释中国经济运行进程中的大 Chinese economy. For instance, the property cycle moves in

部分异动。譬如,房地产周期与螺纹钢、债券收益率、 tandem with rebar, bond yield, stock market indices, CNY

股指、人民币汇率、货币供应增长、中国央行资产负债 exchange rate, money supply growth, the PBoC’s balance

表等指标休戚相关(附录 1-4)。 sheet and so on (Appendix 1-4).

房地产周期每三至四年运行一轮。如果当前周期肇始于 The property cycle runs every three to four years. If the

2019 年初,尽管于 2020 年被新冠疫情爆发骤然打乱运行 current cycle started in early 2019 (punctured by the

轨迹,但若以史为鉴,那么截至目前,房地产周期应该 pandemic in 2020), if history is a guide, by now the property

接近下一轮新周期的起点(图表 4)。 cycle should be close to the beginning of a new cycle (Figure

4).

CCFA JOURNAL OF FINANCE December 2022

Page 11 第11页