Page 13 - CCFA Journal - Ninth Issue

P. 13

加中金融 市场展望 Market Outlook

2013-2014 年彼时彼日与今时今日

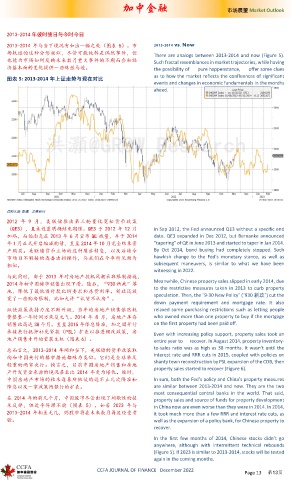

2013-2014 年与当下境况有如出一辙之处(图表 5)。市 2013-2014 vs. Now

场轨迹的这种分形相似,尽管可能纯粹是偶然事件,但 There are analogs between 2013-2014 and now (Figure 5).

也能为市场如何反映未来数月重大事件的不期而会和经 Such fractal resemblances in market trajectories, while having

济基本面的变化提供一些蛛丝马迹。 the possibility of pure happenstance, offer some clues

as to how the market reflects the confluences of significant

图表 5: 2013-2014 年上证走势与现在对比

events and changes in economic fundamentals in the months

ahead.

资料来源 : 彭博,思睿研究

2012 年 9 月,美联储推出第三轮量化宽松货币政策

(QE3),且未设置明确结束期限。QE3 于 2012 年 12 月 In Sep 2012, the Fed announced QE3 without a specific end

加码,而伯南克在 2013 年 6 月宣布 QE 减量,并于 2014 date. QE3 expanded in Dec 2012, but Bernanke announced

年 1 月正式开启缩减购债,直至 2014 年 10 月完全结束资 “tapering” of QE in June 2013 and started to taper in Jan 2014.

产购买。美联储货币立场的这种鹰派转变,以及后续令 By Oct 2014, bond buying had completely stopped. Such

市场目不暇接的连番出招操作,与我们在今年所见颇为 hawkish change to the Fed’s monetary stance, as well as

相似。 subsequent maneuvers, is similar to what we have been

witnessing in 2022.

与此同时,由于 2013 年对房地产投机风潮采取限制措施,

2014 年初中国楼市销售出现下滑。随后,“930 新政”落 Meanwhile, Chinese property sales slipped in early 2014, due

to the restrictive measures taken in 2013 to curb property

地,降低了最低首付款比例要求和房贷利率。新政还放 speculation. Then, the “9-30 New Policy” (“930 新政”) cut the

宽了一些购房限制,比如允许“认贷不认房”。

down payment requirement and mortgage rate. It also

纵使政策扶持力度不断升级,当年的房地产销售依然耗 relaxed some purchasing restrictions such as letting people

费整整一年时间方恢复元气。2014 年 8 月,房地产库存 who owned more than one property to buy if the mortgage

销售比高达 38 个月。直至 2015 年降息降准,加之国开行 on the first property had been paid off.

承接央行抵押补充贷款(PSL)扩表以推进棚改政策,房 Even with increasing policy support, property sales took an

地产销售才开始重获生机(图表 6)。 entire year to recover. In August 2014, property inventory-

to-sales ratio was as high as 38 months. It wasn’t until the

总而言之,2013-2014 年间和当下,美联储的货币政策取

向和中国央行的楼市措施都殊为类似。它们是全球举足 interest rate and RRR cuts in 2015, coupled with policies on

轻重的两家央行。换言之,目前中国房地产销售和房地 shanty town reconstruction by PSL expansion of the CDB, then

property sales started to recover (Figure 6).

产开发资金来源的境况甚至比 2014 年更为堪忧。彼时,

中国房地产市场的枯木逢春所依仗的远不止几次降准和 In sum, both the Fed’s policy and China’s property measures

降息以及一家政策性银行的扩表。 are similar between 2013-2014 and now. They are the two

most consequential central banks in the world. That said,

在 2014 年的前几个月,中国股市尽管出现了间歇性的技 property sales and source of funds for property development

术反弹,但近乎停滞不前(图表 5)。如若 2023 年与 in China now are even worse than they were in 2014. In 2014,

2013-2014 年相差无几,则股市将在未来数月再度经受考 it took much more than a few RRR and interest rate cuts, as

验。 well as the expansion of a policy bank, for Chinese property to

recover.

In the first few months of 2014, Chinese stocks didn’t go

anywhere, although with intermittent technical rebounds

(Figure 5). If 2023 is similar to 2013-2014, stocks will be tested

again in the coming months.

CCFA JOURNAL OF FINANCE December 2022

Page 13 第13页