Page 24 - CCFA Journal - Tenth Issue

P. 24

风险管理 Risk Management 加中金融

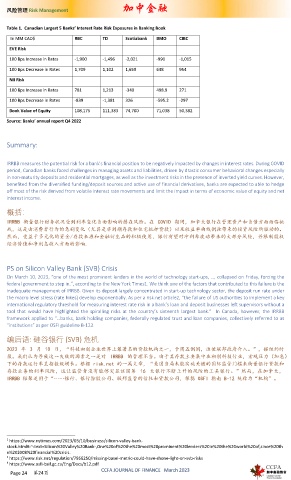

Table 1. Canadian Largest 5 Banks’ Interest Rate Risk Exposures in Banking Book

In MM CAD$ RBC TD Scotiabank BMO CIBC

EVE Risk

100 Bps Increase in Rates -1,900 -1,496 -2,021 -990 -1,015

100 Bps Decrease in Rates 1,709 1,102 1,659 648 954

NII Risk

100 Bps Increase in Rates 781 1,213 -340 498.9 271

100 Bps Decrease in Rates -839 -1,381 326 -595.2 -297

Book Value of Equity 108,175 111,383 74,700 71,038 50,382

Source: Banks’ annual report Q4 2022

Summary:

IRRBB measures the potential risk for a bank's financial position to be negatively impacted by changes in interest rates. During COVID

period, Canadian banks faced challenges in managing assets and liabilities, driven by drastic consumer behavioral changes especially

in non-maturity deposits and residential mortgages, as well as the investment risks in the presence of inverted yield curves. However,

benefited from the diversified funding/deposit sources and active use of financial derivatives, banks are expected to able to hedge

off most of the risk derived from volatile interest rate movements and limit the impact in terms of economic value of equity and net

interest income.

概括:

IRRBB 衡量银行财务状况受到利率变化负面影响的潜在风险。在 COVID 期间,加拿大银行在管理资产和负债方面面临挑

战,这是由消费者行为的急剧变化(尤其是非到期存款和住宅抵押贷款)以及收益率曲线倒挂带来的投资风险所驱动的。

然而,受益于多元化的资金/存款来源和金融衍生品的积极使用,银行有望对冲利率波动带来的大部分风险,并限制股权

经济价值和净利息收入方面的影响.

PS on Silicon Valley Bank (SVB) Crisis

On March 10, 2023, “one of the most prominent lenders in the world of technology start-ups, …, collapsed on Friday, forcing the

federal government to step in.”, according to the New York Times1. We think one of the factors that contributed to this failure is the

inadequate management of IRRBB. Given its deposit largely concentrated in start-up technology sector, the deposit run rate under

the macro level stress (rate hikes) develop exponentially. As per a risk.net article2, “the failure of US authorities to implement a key

international regulatory threshold for measuring interest rate risk in a bank’s loan and deposit businesses left supervisors without a

tool that would have highlighted the spiralling risks at the country’s sixteenth largest bank.” In Canada, however, the IRRBB

framework applied to “…banks, bank holding companies, federally regulated trust and loan companies, collectively referred to as

“institutions” as per OSFI guideline B-123.

编后语: 硅谷银行 (SVB) 危机

2023 年 3 月 10 日,“科技初创企业世界上最著名的贷款机构之一,于周五倒闭,迫使联邦政府介入。”,据纽约时

报。我们认为导致这一失败的因素之一是对 IRRBB 的管理不当。由于其存款主要集中在初创科技行业,宏观压力(加息)

下的存款运行率呈指数级增长。根据 risk.net 的一篇文章,“美国当局未能实施关键的国际监管门槛来衡量银行贷款和

存款业务的利率风险,这让监管者没有能够突显该国第 16 大银行不断上升的风险的工具银行。”然而,在加拿大,

IRRBB 框架适用于“……银行、银行控股公司、联邦监管的信托和贷款公司,根据 OSFI 指南 B-12 统称为“机构”。

1 https://www.nytimes.com/2023/03/10/business/silicon-valley-bank-

stock.html#:~:text=Silicon%20Valley%20Bank-,One%20of%20the%20most%20prominent%20lenders%20in%20the%20world%20of,since%20th

e%202008%20financial%20crisis.

2 https://www.risk.net/regulation/7956250/missing-basel-metric-could-have-shone-light-on-svb-risks

3 https://www.osfi-bsif.gc.ca/Eng/Docs/b12.pdf

CCFA JOURNAL OF FINANCE March 2023

Page 24 第24页