Page 25 - CCFA Journal - 8th Issue

P. 25

加中金融 风险控制 Risk Management

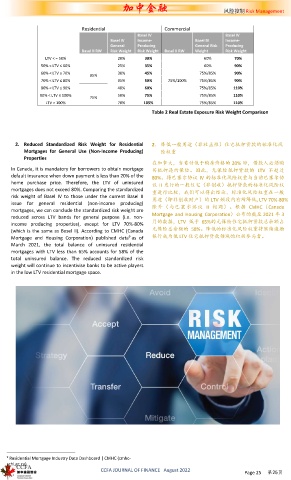

Residential Commercial

Basel IV

Basel IV

Basel IV Income- Basel IV Income-

General Producing General Risk Producing

Basel II RW Risk Weight Risk Weight Basel II RW Weight Risk Weight

LTV < = 50% 20% 30% 60% 70%

50% < LTV ≤ 60% 25% 35% 60% 90%

60% < LTV ≤ 70% 35% 30% 45% 75%/85% 90%

70% < LTV ≤ 80% 35% 50% 75%/100% 75%/85% 90%

80% < LTV ≤ 90% 40% 60% 75%/85% 110%

90% < LTV ≤ 100% 75% 50% 75% 75%/85% 110%

LTV > 100% 70% 105% 75%/85% 110%

Table 2 Real Estate Exposure Risk Weight Comparison

2. Reduced Standardized Risk Weight for Residential 2. 降低一般用途(非收益性)住宅抵押贷款的标准化风

Mortgages for General Use (Non-Income Producing) 险权重

Properties

在加拿大,当首付低于购房价格的 20% 时,借款人必须购

In Canada, it is mandatory for borrowers to obtain mortgage 买抵押违约保险。因此,无保险抵押贷款的 LTV 不超过

default insurance when down payment is less than 20% of the 80%。将巴塞尔协议 IV 的标准化风险权重与当前巴塞尔协

home purchase price. Therefore, the LTV of uninsured 议 II 发行的一般住宅(非创收)抵押贷款的标准化风险权

mortgages does not exceed 80%. Comparing the standardized 重进行比较,我们可以得出结论,标准化风险权重在一般

risk weight of Basel IV to those under the current Basel II 用途(即非创收财产)的 LTV 频段内有所降低, LTV 70%-80%

issue for general residential (non-income producing)

mortgages, we can conclude the standardized risk weight are 除外(与巴塞尔协议 II 相同)。根据 CMHC(Canada

reduced across LTV bands for general purpose (i.e. non- Mortgage and Housing Corporation)公布的截至 2021 年 3

income producing properties), except for LTV 70%-80% 月的数据,LTV 低于 65%的无保险住宅抵押贷款总余额占

(which is the same as Basel II). According to CMHC (Canada 无保险总余额的 58%。降低的标准化风险权重将继续激励

9

Mortgage and Housing Corporation) published data as of 银行成为低 LTV 住宅抵押贷款领域的积极参与者。

March 2021, the total balance of uninsured residential

mortgages with LTV less than 65% accounts for 58% of the

total uninsured balance. The reduced standardized risk

weight will continue to incentivise banks to be active players

in the low LTV residential mortgage space.

9 Residential Mortgage Industry Data Dashboard | CMHC (cmhc-

schl.gc.ca)

CCFA JOURNAL OF FINANCE August 2022 Page 25 第25页