Page 32 - CCFA Journal - 8th Issue

P. 32

合规 Governance 加中金融

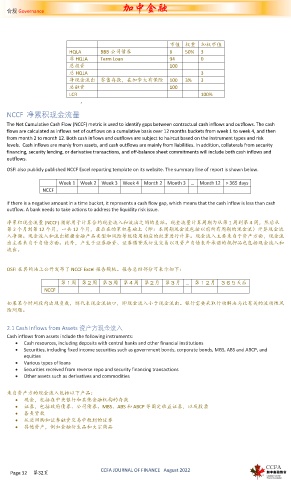

市值 权重 加权市值

HQLA BBB 公司债券 6 50% 3

非 HQLA Term Loan 94 0

总投资 100

总 HQLA 3

净现金流出 零售存款,在加拿大有保险 100 3% 3

总融资 100

LCR 100%

,

NCCF 净累积现金流量

The Net Cumulative Cash Flow (NCCF) metric is used to identify gaps between contractual cash inflows and outflows. The cash

flows are calculated as inflows net of outflows on a cumulative basis over 12 months buckets from week 1 to week 4, and then

from month 2 to month 12. Both cash inflows and outflows are subject to haircut based on the instrument types and risk

levels. Cash inflows are manly from assets, and cash outflows are mainly from liabilities. In addition, collaterals from security

financing, security lending, or derivative transactions, and off-balance sheet commitments will include both cash inflows and

outflows.

OSFI also publicly published NCCF Excel reporting template on its website. The summary line of report is shown below.

Week 1 Week 2 Week 3 Week 4 Month 2 Month 3 … Month 12 > 365 days

NCCF

If there is a negative amount in a time bucket, it represents a cash flow gap, which means that the cash inflow is less than cash

outflow. A bank needs to take actions to address the liquidity risk issue.

净累积现金流量 (NCCF) 指标用于计算合约现金流入和流出之间的差距。现金流量计算周期为从第 1 周到第 4 周,然后从

第 2 个月到第 12 个月,一共 12 个月,最后在的累积基础上(即:本周期现金流包括以前所有周期的现金流)计算现金流

入净额。现金流入和流出根据金融产品类型和风险等级使用相应的权重进行计算。现金流入主要来自于资产方面,现金流

出主要来自于负债方面。此外,产生于证券融资、证券借贷或衍生交易以及资产负债表外承诺的抵押品也包括现金流入和

流出。

OSFI 在其网站上公开发布了 NCCF Excel 报告模板。报告总结部分可表示如下:

第1周 第2周 第3周 第4周 第2月 第3月 … 第12月 365天后

NCCF

如果某个时间段内出现负数,则代表现金流缺口,即现金流入小于现金流出。银行需要采取行动解决与此有关的流动性风

险问题。

2.1 Cash Inflows from Assets 资产方现金流入

Cash inflows from assets include the following instruments:

Cash resources, including deposits with central banks and other financial institutions

Securities, including fixed income securities such as government bonds, corporate bonds, MBS, ABS and ABCP, and

equities

Various types of loans

Securities received from reverse repo and security financing transactions

Other assets such as derivatives and commodities

来自资产方的现金流入包括以下产品:

现金,包括在中央银行和其他金融机构的存款

证券,包括政府债券、公司债券、MBS、ABS 和 ABCP 等固定收益证券,以及股票

各类贷款

从逆回购和证券融资交易中收到的证券

其他资产,例如金融衍生品和大宗商品

CCFA JOURNAL OF FINANCE August 2022

Page 32 第32页