Page 35 - CCFA Journal - 8th Issue

P. 35

加中金融 风规 Governance

背景

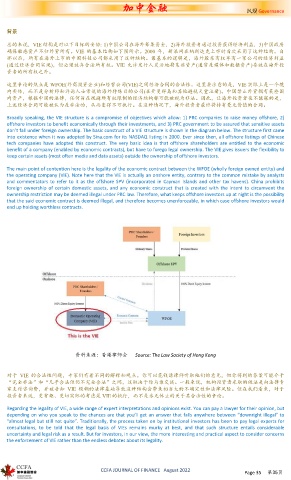

总的来说,VIE 结构是对以下目标的妥协: 1)中国公司在海外筹集资金,2)海外投资者通过投资获得经济利益,3)中国政府

确保敏感资产不归外资所有。VIE 的基本结构如下图所示。2000 年,新浪网在纳斯达克上市时首次采用了这种结构。自

那以后,所有在海外上市的中国科技公司都采用了这种结构。最基本的逻辑是,海外股东有权享有一家公司的经济利益

(通过经济合同实现),但必须放弃合法所有权。VIE 允许发行人灵活地将某些资产(通常是媒体和数据资产)存放在海外投

资者的所有权之外。

这里争论的焦点是 WFOE(外商投资企业)和经营公司(VIE)之间经济合同的合法性。这里要注意的是,VIE 实际上是一个境

内实体,而不是分析师和评论人士常说的海外特殊目的公司(在开曼群岛和其他避税天堂注册)。中国禁止外资拥有某些国

内资产,根据中国的法律,任何旨在规避所有权限制的经济结构都可能被视为非法。因此,让海外投资者夜不能寐的是,

上述经济合同可能被认为是非法的,从而变得不可执行。在这种情况下,海外投资者最终将持有毫无价值的合同。

Broadly speaking, the VIE structure is a compromise of objectives which allow: 1) PRC companies to raise money offshore, 2)

offshore investors to benefit economically through their investments, and 3) PRC government to be assured that sensitive assets

don’t fall under foreign ownership. The basic construct of a VIE structure is shown in the diagram below. The structure first came

into existence when it was adopted by Sina.com for its NASDAQ listing in 2000. Ever since then, all offshore listings of Chinese

tech companies have adopted this construct. The very basic idea is that offshore shareholders are entitled to the economic

benefit of a company (enabled by economic contracts), but have to forego legal ownership. The VIE gives issuers the flexibility to

keep certain assets (most often media and data assets) outside the ownership of offshore investors.

The main point of contention here is the legality of the economic contract between the WFOE (wholly foreign owned entity) and

the operating company (VIE). Note here that the VIE is actually an onshore entity, contrary to the common mistake by analysts

and commentators to refer to it as the offshore SPV (incorporated in Cayman Islands and other tax havens). China prohibits

foreign ownership of certain domestic assets, and any economic construct that is created with the intent to circumvent the

ownership restriction may be deemed illegal under PRC law. Therefore, what keeps offshore investors up at night is the possibility

that the said economic contract is deemed illegal, and therefore becomes unenforceable, in which case offshore investors would

end up holding worthless contracts.

资料来源:香港律师会 Source: The Law Society of Hong Kong

对于 VIE 的合法性问题,专家们有着不同的解释和观点。你可以花钱请律师听取他们的意见,但你得到的答案可能介于

“完全非法”和“几乎合法但仍不完全合法”之间,这取决于你与谁交谈。一般来说,机构投资者采取的做法是向法律专

家支付咨询费,并被告知 VIE 模糊的法律基础导致这种结构会带来相当大的不确定性和法律风险。但在我们看来,对于

投资者来说,更有趣、更切实际的考虑是 VIE 的执行,而不是永无休止的关于其合法性的争论。

Regarding the legality of VIE, a wide range of expert interpretations and opinions exist. You can pay a lawyer for their opinion, but

depending on who you speak to the chances are that you’ll get an answer that falls anywhere between “downright illegal” to

“almost legal but still not quite”. Traditionally, the process taken on by institutional investors has been to pay legal experts for

consultations, to be told that the legal basis of VIEs remains murky at best, and that such structure entails considerable

uncertainty and legal risk as a result. But for investors, in our view, the more interesting and practical aspect to consider concerns

the enforcement of VIE rather than the endless debates about its legality.

CCFA JOURNAL OF FINANCE August 2022 Page 35 第35页