Page 4 - Annual Report 2020

P. 4

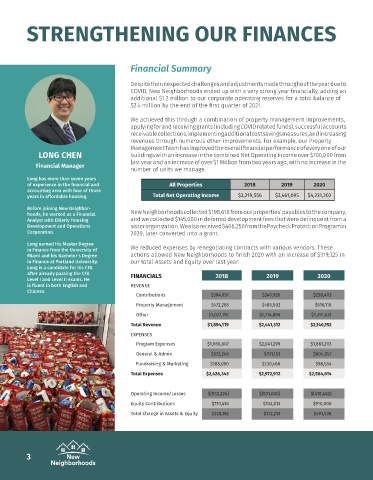

STRENGTHENING OUR FINANCES

Financial Summary

Despite the unexpected challenges and adjustments made throughout the year due to

COVID, New Neighborhoods ended up with a very strong year financially, adding an

additional $1.2 million to our corporate operating reserves for a total balance of

$2.4 million by the end of the first quarter of 2021.

We achieved this through a combination of property management improvements,

applying for and receiving grants (including COVID related funds), successful accounts

receivable collections, implementing additional cost savings measures, and increasing

revenues through numerous other improvements. For example, our Property

Management Team has improved the overall financial performance of every one of our

LONG CHEN buildings with an increase in the combined Net Operating Income over $700,000 from

last year and an increase of over $1 Million from two years ago, with no increase in the

Financial Manager

number of units we manage.

Long has more than seven years

of experience in the financial and All Properties 2018 2019 2020

accounting area with four of those

years in affordable housing. Total Net Operating Income $3,219,556 $3,461,095 $4,231,202

Before joining New Neighbor- New Neighborhoods collected $198,618 from our properties’ payables to the company,

hoods, he worked as a Financial

Analyst with Elderly Housing and we collected $145,000 in deferred development fees that were delinquent from a

Development and Operations sister organization. We also received $406,250 from the Paycheck Protection Program in

Corporation. 2020, later converted into a grant.

Long earned his Master Degree We reduced expenses by renegotiating contracts with various vendors. These

in Finance from the University of

Miami and his Bachelor’s Degree actions allowed New Neighborhoods to finish 2020 with an increase of $319,325 in

in Finance at Portland University. our total Assets and Equity over last year.

Long is a candidate for his CFA

after already passing the CFA FINANCIALS 2018 2019 2020

Level I and Level II exams. He

is fluent in both English and REVENUE

Chinese.

Contributions $394,057 $240,920 $238,403

Property Management $472,265 $485,502 $516,118

Other $1,027,797 $1,714,890 $1,391,631

Total Revenue $1,894,119 $2,441,312 $2,146,152

EXPENSES

Program Expenses $1,666,007 $2,041,299 $1,861,203

General & Admin $572,246 $701,153 $604,857

Fundraising & Marketing $188,090 $230,460 $98,554

Total Expenses $2,426,343 $2,972,912 $2,564,614

Operating Income/Losses $(532,224) $(531,600) $(418,462)

Equity Contributions $770,416 $703,813 $910,000

Total Change in Assets & Equity $238,192 $172,213 $491,538

3