Page 4 - 2019 Annual Report

P. 4

STRENGTHENING OUR FINANCES

Summary

2019 was a very productive year for our organization from a financial standpoint. Throughout the year we

focused our efforts towards our internal operations by seeking out the most efficient and effective ways to

improve our organization. The numerous improvements that were made are now paying off. Below, are some

examples of those improvements along with the financial impact to our bottom line. In addition to these

adjustments, a large portion of our strengthened finances are directly related to improvements made with

our property management team’s overall performance. Through reducing vacancies, controlling expenses,

minimizing delinquencies, and maximizing subsidy programs, our property management team has lowered

overall costs while maximizing the property revenues. The results have allowed us to establish an operating

reserve account for the first time, that can be used for emergencies or future development projects.

LONG CHEN Improved Efficiencies

Financial Manager

We spent most of 2019 converting our Finance and Operating Systems over to RealPage. RealPage not only

Long has more than six years of experi- streamlines our workflow, but it also saves us money. The value of actual savings plus our efficiency savings

ence in the financial and accounting area

with three of those years in affordable from our old systems to RealPage is projected to be $63,000 annually. We also converted over 70% of our

housing. Before joining New Neighbor- accounts payables process to a paperless system saving us a $36,000 annually. An electronic Purchase Order

hoods, he worked as a Financial Analyst System utilizes another RealPage function and streamlined our purchase order process with direct payments

with Elderly Housing Development and that benefits our organization by roughly $75,000 annually in actual and efficiency savings, as well as elimi-

Operations Corporation.

nates errors, and speeds up the process of filling orders.

Long earned his Master Degree in

Finance from the University of Miami In addition, we changed how we purchased “blank checks” saving us over $6,000 annually, switched to a new

and his Bachelor’s Degree in Finance at Phone System with a projected savings of $27,000 annually, replaced our insurance provider, saving another

Portland University. Long is a candidate $30,000 annually, and renegotiated our corporate lease agreement freezing our rent costs for 2019. These

for his CFA after already passing the CFA improvements and more helped strengthen our overall bottom line in 2019.

Level I and Level II exams. He is fluent in

both English and Chinese.

Below is a breakdown of our finances from 2019 and the two years prior.

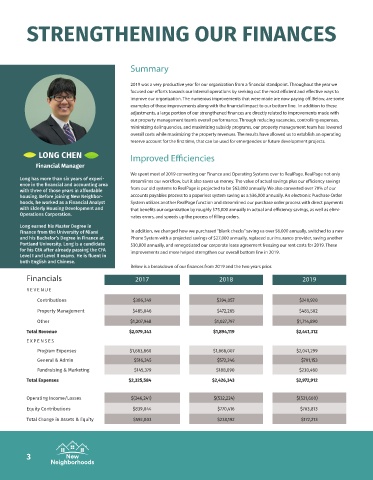

Financials 2017 2018 2019

RE VENUE

Contributions $386,349 $394,057 $240,920

Property Management $485,046 $472,265 $485,502

Other $1,207,948 $1,027,797 $1,714,890

Total Revenue $2,079,343 $1,894,119 $2,441,312

EXPENSES

Program Expenses $1,663,860 $1,666,007 $2,041,299

General & Admin $516,345 $572,246 $701,153

Fundraising & Marketing $145,379 $188,090 $230,460

Total Expenses $2,325,584 $2,426,343 $2,972,912

Operating Income/Losses $(246,241) $(532,224) $(531,600)

Equity Contributions $839,044 $770,416 $703,813

Total Change in Assets & Equity $592,803 $238,192 $172,213

3