Page 289 - 2021-2022 New Hire Benefits

P. 289

Note: The variability of Renbrook’s contribution presents an administrative challenge insofar as

the employee’s annual contribution is concerned. By early in September, all employees will be

given a short window of opportunity to give the school written instructions on how to proceed.

Absent any such directive, and only when an employee has elected to make a contribution will

fall below the requirements detailed above, the school will automatically proceed to increase the

contributions to maintain your eligibility for School contributions until directed otherwise by you.

No action will be taken regarding employee contributions that exceed the plan’s minimum

requirement.

Investment of Your Accounts:

• The School offers a choice of investment funds for your account through the TIAA platform.

• Statements of your accounts are sent quarterly by TIAA.

• As noted above, please refer to the Summary Plan Description for your ERISA rights and other

important information including income tax considerations and distribution of benefits.

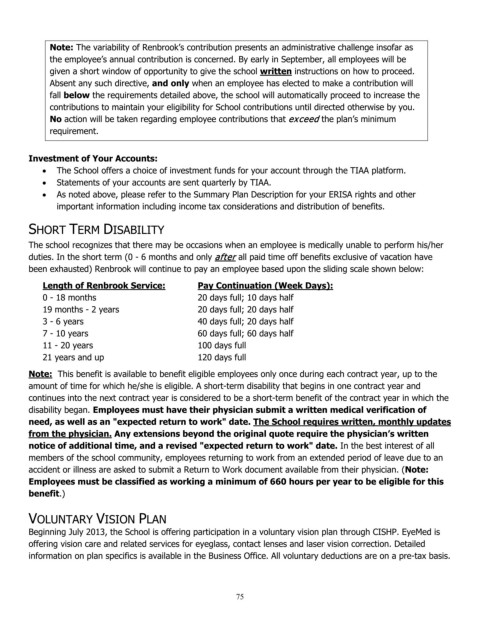

SHORT TERM DISABILITY

The school recognizes that there may be occasions when an employee is medically unable to perform his/her

duties. In the short term (0 - 6 months and only after all paid time off benefits exclusive of vacation have

been exhausted) Renbrook will continue to pay an employee based upon the sliding scale shown below:

Length of Renbrook Service: Pay Continuation (Week Days):

0 - 18 months 20 days full; 10 days half

19 months - 2 years 20 days full; 20 days half

3 - 6 years 40 days full; 20 days half

7 - 10 years 60 days full; 60 days half

11 - 20 years 100 days full

21 years and up 120 days full

Note: This benefit is available to benefit eligible employees only once during each contract year, up to the

amount of time for which he/she is eligible. A short-term disability that begins in one contract year and

continues into the next contract year is considered to be a short-term benefit of the contract year in which the

disability began. Employees must have their physician submit a written medical verification of

need, as well as an "expected return to work" date. The School requires written, monthly updates

from the physician. Any extensions beyond the original quote require the physician’s written

notice of additional time, and a revised "expected return to work" date. In the best interest of all

members of the school community, employees returning to work from an extended period of leave due to an

accident or illness are asked to submit a Return to Work document available from their physician. (Note:

Employees must be classified as working a minimum of 660 hours per year to be eligible for this

benefit.)

VOLUNTARY VISION PLAN

Beginning July 2013, the School is offering participation in a voluntary vision plan through CISHP. EyeMed is

offering vision care and related services for eyeglass, contact lenses and laser vision correction. Detailed

information on plan specifics is available in the Business Office. All voluntary deductions are on a pre-tax basis.

75