Page 98 - 2021-2022 New Hire Benefits

P. 98

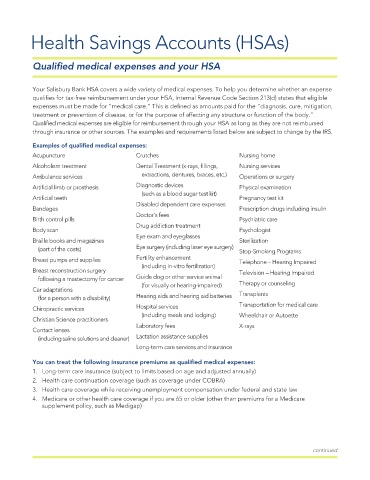

Health Savings Accounts (HSAs)

Qualified medical expenses and your HSA

Your Salisbury Bank HSA covers a wide variety of medical expenses. To help you determine whether an expense

qualifies for tax-free reimbursement under your HSA, Internal Revenue Code Section 213(d) states that eligible

expenses must be made for “medical care.” This is defined as amounts paid for the “diagnosis, cure, mitigation,

treatment or prevention of disease, or for the purpose of affecting any structure or function of the body.”

Qualified medical expenses are eligible for reimbursement through your HSA as long as they are not reimbursed

through insurance or other sources. The examples and requirements listed below are subject to change by the IRS.

Examples of qualified medical expenses:

Acupuncture Crutches Nursing home

Alcoholism treatment Dental Treatment (x-rays, fillings, Nursing services

Ambulance services extractions, dentures, braces, etc.) Operations or surgery

Artificial limb or prosthesis Diagnostic devices Physical examination

(such as a blood sugar test kit)

Artificial teeth Pregnancy test kit

Disabled dependent care expenses

Bandages Prescription drugs including insulin

Doctor’s fees

Birth control pills Psychiatric care

Drug addiction treatment

Body scan Psychologist

Eye exam and eyeglasses

Braille books and magazines Sterilization

(part of the costs) Eye surgery (including laser eye surgery) Stop-Smoking Programs

Breast pumps and supplies Fertility enhancement Telephone – Hearing Impaired

(including in-vitro fertilization)

Breast reconstruction surgery Television – Hearing Impaired

following a mastectomy for cancer Guide dog or other service animal

(for visually or hearing-impaired) Therapy or counseling

Car adaptations Transplants

(for a person with a disability) Hearing aids and hearing aid batteries

Chiropractic services Hospital services Transportation for medical care

(including meals and lodging) Wheelchair or Autoette

Christian Science practitioners

Laboratory fees X-rays

Contact lenses

(including saline solutions and cleaner) Lactation assistance supplies

Long-term care services and insurance

You can treat the following insurance premiums as qualified medical expenses:

1. Long-term care insurance (subject to limits based on age and adjusted annually)

2. Health care continuation coverage (such as coverage under COBRA)

3. Health care coverage while receiving unemployment compensation under federal and state law

4. Medicare or other health care coverage if you are 65 or older (other than premiums for a Medicare

supplement policy, such as Medigap)

continued