Page 24 - F6 - Capital Allowances - Leases

P. 24

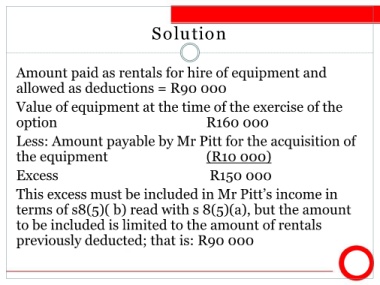

Solution

Amount paid as rentals for hire of equipment and

allowed as deductions = R90 000

Value of equipment at the time of the exercise of the

option R160 000

Less: Amount payable by Mr Pitt for the acquisition of

the equipment (R10 000)

Excess R150 000

This excess must be included in Mr Pitt’s income in

terms of s8(5)( b) read with s 8(5)(a), but the amount

to be included is limited to the amount of rentals

previously deducted; that is: R90 000