Page 19 - F6 - Capital Allowances - Leases

P. 19

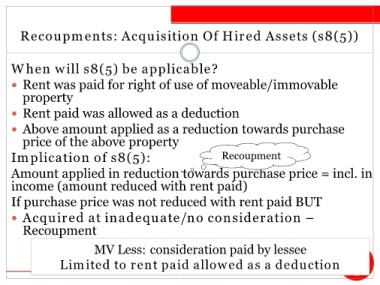

Recoupments: Acquisition Of Hired Assets (s8(5))

When will s8(5) be applicable?

Rent was paid for right of use of moveable/immovable

property

Rent paid was allowed as a deduction

Above amount applied as a reduction towards purchase

price of the above property

Implication of s8(5): Recoupment

Amount applied in reduction towards purchase price = incl. in

income (amount reduced with rent paid)

If purchase price was not reduced with rent paid BUT

Acquired at inadequate/no consideration –

Recoupment

MV Less: consideration paid by lessee

Limited to rent paid allowed as a deduction