Page 14 - F6 - Capital Allowances - Leases

P. 14

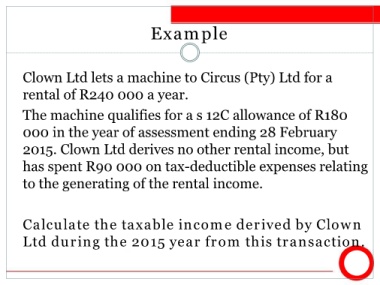

Example

Clown Ltd lets a machine to Circus (Pty) Ltd for a

rental of R240 000 a year.

The machine qualifies for a s 12C allowance of R180

000 in the year of assessment ending 28 February

2015. Clown Ltd derives no other rental income, but

has spent R90 000 on tax-deductible expenses relating

to the generating of the rental income.

Calculate the taxable income derived by Clown

Ltd during the 2015 year from this transaction.